Despite the S&P 500 Index (^SPX) being within 2% of its all-time high, sentiment has been turning more bearish over the last several weeks. While these tempered expectations could allow stocks to slowly drift higher, perhaps it will have investors in a better position should a summer swoon hit US stocks, observes Bret Kenwell, US investment analyst at eToro.

The latest AAII survey data showed that bearish sentiment has now hit its highest level since mid-May, while bullish sentiment is near a two-month low.

Meanwhile, since 2000, September has consistently been the worst month for US equities — an observation that also holds true when looking at the last five and ten years. Further, September has been a particularly painful month for markets since 2020, with the S&P 500 falling at least 4% in three of the last four years.

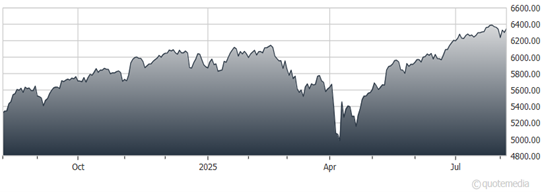

S&P 500 Index (^SPX)

When looking at rolling two-month returns, the August-September timeframe is the worst period for S&P 500 performance over the last 10 and 25 years, averaging a decline of 1.4% and 1.9%, respectively.

In 2025, momentum has been strong, with the S&P 500 up more than 30% from the April lows. Further, more than 80% of S&P 500 firms have beat earnings expectations so far this quarter. In other words, the technicals and the fundamentals have been working in the bulls’ favor.

However, trading volumes tend to decline in the summer and markets have been experiencing an uptick in volatility since a hot inflation report in late July and a disappointing jobs report on Aug. 1. While markets have brushed off trade-war worries over the past few months, that situation is back on investors’ radar.

It’s healthy price action for stocks to consolidate after a big rally — either by pulling back or digesting the move by trading sideways. That could open the door to a minor dip in the S&P 500 of about 5%. That would also allow the index to retest the breakout level over its prior highs near 6,100 to 6,150 — and potentially lead to something a little larger in the 5% to 10% range.

Either way, this pullback would likely be viewed as an opportunity for investors to buy the dip rather than run for the hills.