After the July CPI print came in better than expected, it virtually guaranteed that a rate cut is slated for September. That acknowledgement ignited a monster small-cap rally, as you can see by looking at the iShares Russell 2000 ETF (IWM), highlights Lucas Downey, co-founder of MoneyFlows.

Today we’ll unpack a lot of new data insights – including why the small-cap rally that many have been waiting for could be in the early inning.

First, our recent call for market breadth deterioration came and left quickly. Small-caps, in particular, saw a steep decline before a breathtaking rally. From July 23 – Aug. 1, the Russell 2000 fell 5.4%. But that ultimately led to a huge risk-on event. Since the Aug. 1 low, outflows dried up and inflows surged.

So what changed over two days? The odds of a September Fed rate cut surged to nearly 100%. This is meaningful for the left-behind small-cap cohort. Some 91% of inflows were focused in companies below $50B market cap.

(Editor’s Note: MoneyFlows co-founder Jason Bodner is speaking at the 2025 MoneyShow/TradersEXPO Orlando, scheduled for Oct. 16-18. Click HERE to register.)

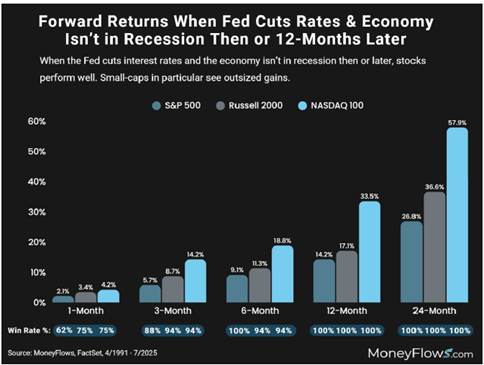

Folks, this didn’t happen by chance. The Big Money knows who benefits from rate cuts: Smaller undercapitalized firms. When the Fed cuts rates and the economy isn’t in a recession and doesn’t fall into recession 12 months later, small-caps soar. Look at the chart above showing how 12 months after rate cuts, the Russell 2000 jumps 17.1% on average.

The latest rally means that the party is just getting started. Not just because of our studies, but due to what technically happened this week. A violent up-move of this magnitude rarely comes along. The message is clear: Start broadening out your stock list.

As rates come down, this will unlock pressure on smaller companies that have been penalized for years. There’s a whole world of alpha outside of the Mag 7. Given these mammoth shifts this week, expect new leadership to emerge. Our data shows the individual names getting accumulated day after day.