Valued at $44.4 billion, eBay Inc. (EBAY) is an online shopping site that has evolved from a relatively small community user-based auction host to a commercial behemoth. It checks the boxes I like to see – including superior current momentum in both strength and direction and a Trend Seeker “Buy” signal, writes Jim Van Meerten, analyst at Barchart.

Since the Trend Seeker signaled a buy on July 10, the stock has gained 25.6%. eBay shares also hit a new all-time high on Aug. 13, topping $98.

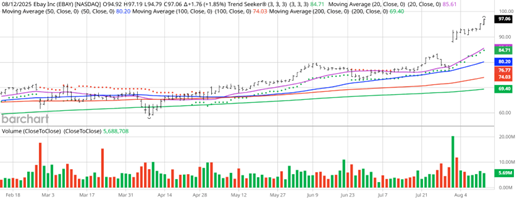

EBAY Price vs. Daily Moving Averages

The stock has a Weighted Alpha of +89.6, a 100% “Buy” opinion from Barchart, and it’s trading above its 20-, 50-, and 100-day moving averages. The Relative Strength Index is at 81.1% and there’s a technical support level around $95.50.

Revenue is projected to grow 5.4% this year and another 4.7% next year, while earnings are estimated to increase 11.9% this year and an additional 9% next year. The Wall Street analysts tracked by Barchart have issued nine “Strong Buy,” two “Moderate Buy,” 17 “Hold,” and 2 “Sell” opinions on the stock. Their price targets are between $60-$107.

Bottom line? EBAY currently has momentum and is hitting new highs. I caution that EBAY is volatile and even speculative in the current environment, which means investors should use strict risk management and stop-loss strategies.