You can show market rotation in a LOT of different ways. Me? I’m going to focus on the “Out of Palantir, Into Pampers” move!

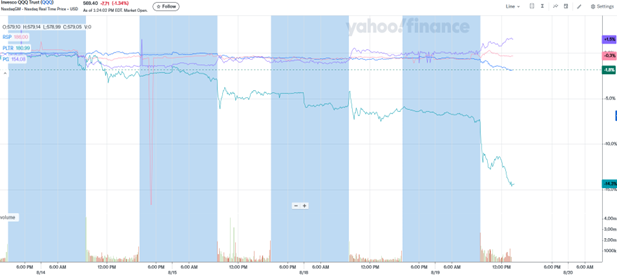

Take a look at the MoneyShow Chart of the Day. It shows the five-day percentage change in Palantir Technologies Inc. (PLTR), Procter & Gamble Co. (PG), the Invesco QQQ Trust (QQQ), and the Invesco S&P 500 Equal Weight ETF (RSP), as of mid-afternoon Tuesday.

PLTR, PG, QQQ, RSP (5-Day % Change)

Source: Yahoo Finance

As you probably know, Palantir is one of the hottest Artificial Intelligence (AI) stocks on the market. As you may know if you have children, Procter makes...Pampers-brand diapers. The former has been beating the pants off the latter – until the last few days. During that time, PLTR dropped more than 14%, while PG rose 1.5%.

The story is the same – though the divergence is less extreme – when you compare the “Big Tech”-dominated QQQ to RSP. That ETF tracks an equally weighted version of the S&P 500 Index (^SPX), rather than the market cap-weighted version. QQQ lost 1.8% during the last five days, while RSP gained 0.3%.

So far, this is just “interesting” market action…not “potentially earth shattering.” We’re only talking about a few days of trading, after all. And on a year-to-date basis, PLTR is STILL crushing PG, up 110% versus down 5.9%.

But we have seen a few other rotational days recently. That includes days where small caps have outshined big caps...and where former losers have outperformed former winners. If we string more of those together, it COULD signal a bigger trend – and it might be time to adjust your portfolio’s sails. Stay tuned!