If you’re familiar with Bitcoin, you will probably have heard about how well it does during Octobers. That cyclicality has been so reliable, the term “Uptober” was coined to reflect it. It is now such a significant part of investor Q4 strategies, that it begins earlier, explains Eoin Treacy, editor of Fuller Treacy Money.

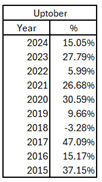

By buying on Oct. 1 and selling on Oct. 31, you would have made money nine out of ten times over the last decade. In creating the table here, I moved three closing values to Nov. 1 because Oct. 31 fell on a weekend. The year 2018 delivered the only negative return – and that was during one of the most significant winters for the asset.

By buying on Oct. 1 and selling on Oct. 31, you would have made money nine out of ten times over the last decade. In creating the table here, I moved three closing values to Nov. 1 because Oct. 31 fell on a weekend. The year 2018 delivered the only negative return – and that was during one of the most significant winters for the asset.

A 90% positive return for a 30-day holding period is enough to get most traders excited. The best thing about cyclicality is noticing it before it enters the public sphere of discussion. The more people know about it, the more likely the market is to adjust to it.

The big bull trends in Bitcoin have tended to begin after the halving of the reward for mining. That occurs once every four years. In 2024, the price was already at a new high before the halving. That reflected the actions of traders as they anticipated the breakout.

I have long described this as Heisenberg’s Uncertainty Principle as it applies to markets. The more the crowd talks about a trend, the less predictable it will be. Maybe a better way to think about it is to adjust the adage “buy the rumour, sell the news.” When a cycle goes from being a rumour to being the news, it becomes less predicative.

So, what does this mean for Bitcoin now? We are still six weeks out from October, so it might be a little early to draw conclusions. Bitcoin hit a new high several days ago and looked like it was ready to run ahead of Uptober. That breakout failed and it is now testing the lower side of the short-term range.

The $110,000 level is a significant area of potential support. If the uptrend is to remain consistent, it will find support within the next $2,000 trading band.