The selling in growth stocks seen under the surface two weeks ago accelerated last week, with the Nasdaq off nearly 2.5% coming into Friday. Of course, Fed Chair Powell’s speech hinted toward a rate cut coming up — helping the major indexes very nicely. But even so, it still seems like a split-tape environment, highlights Mike Cintolo, editor of Cabot Top Ten Trader.

The intermediate-term trend of the major indexes is positive, with them holding north of their 50-day lines. But it’s not powerful because we haven’t seen a lot of progress in recent weeks, net-net. Individual stocks are also more mixed. Many growth leaders are cracking or hitting air pockets, though lots of other areas are holding relatively well.

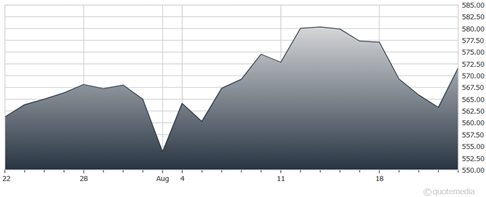

Invesco QQQ Trust (QQQ)

We’re seeing a lot of crosscurrents out there, which, after a prolonged intermediate-term rally, makes it trickier to make (and hold onto) money. To this point, the top-down evidence remains more positive than not, though, and the wobbles seen in many stocks are still relatively normal.

We’re staying flexible, and Friday’s Jackson Hole speech could change the outlook. If it does, we’ll let you know. For now, we’ll leave our Market Monitor at Level 7.