Mining shares have been on fire all year long. But what will it take to get a different batch of commodity stocks moving? I’m talking, of course, about ENERGY names.

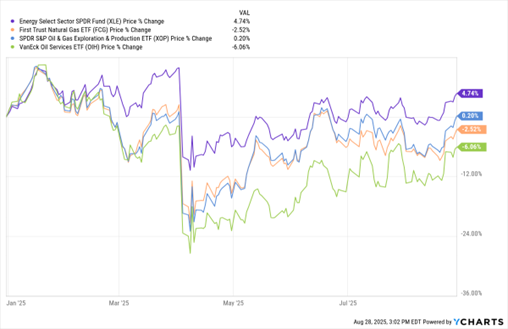

Take a look at the MoneyShow Chart of the Day. It shows the year-to-date performance of the Energy Select Sector SPDR Fund (XLE), First Trust Natural Gas ETF (FCG), SPDR Oil & Gas Exploration & Production ETF (XOP), and the VanEck Oil Services ETF (OIH).

XLE, FCG, XOP, OIH (YTD % Change)

Data by YCharts

While there is some overlap in holdings, each ETF focuses on different names and subsectors in the crude oil and natural gas businesses. XLE is heavy into mega-cap, multinational, diversified energy names, while FCG holds more gas-heavy producers and transportation companies. Yet the performance overall is similar: Lackluster. It ranges from -6% for OIH to +4.7% for XLE.

What’s the culprit? Concern that too much oil supply is hitting the market at a time when demand growth remains tepid.

This year, OPEC+ members have largely rescinded output cuts that totaled 2.2 million barrels per day (BPD). Overall global supply is expected to grow another 1.9 million BPD next year, according to the International Energy Agency. Meanwhile, global consumption is expected to rise just 700,000 BPD to 104.4 million BPD in 2026.

In short, the supply-demand picture is much cloudier in the energy space than it is in the precious metals market. But as the saying goes, the best cure for low prices is…low prices. We’ll likely see drilling and production activity cool if oil and gas prices remain subdued. That, in turn, will eventually boost investor interest in the sector.

So, if you’re looking for something that hasn’t run YET in the resources sector…or that might offer compelling value…you might want to check out some of the energy funds mentioned here.