“What if we lose tech?” I see a version of that question all the time. But if technology stocks falter…and stocks in the sector I’m going to talk about today pick up the baton…it wouldn’t be so bad. Not by a long shot!

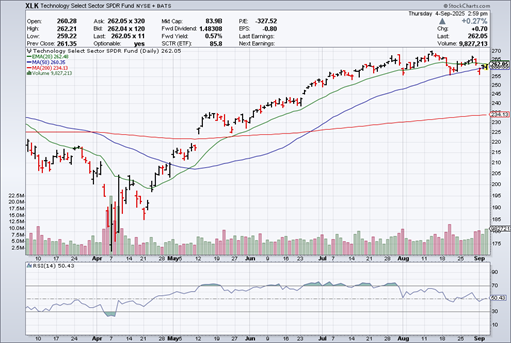

Take a look at my first MoneyShow Chart of the Day. It shows the Technology Select Sector SPDR Fund (XLK) going back six months. You can see that XLK has been flattening out after a long advance…that the Relative Strength Index (RSI) has been weakening...and that we could soon see a negative crossover in shorter-term moving averages (the 20-day and 50-day EMA).

Technology Select Sector SPDR Fund (XLK)

Source: StockCharts

All in all, that tells me tech looks TIRED. But tired isn’t bearish. It wouldn’t be the worst thing if tech took a breather after a huge advance…especially when you consider my SECOND MoneyShow Chart of the Day.

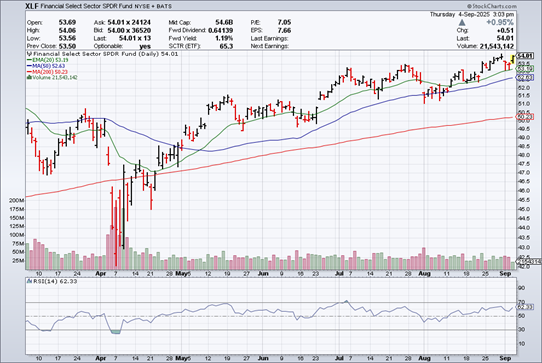

This shows the Financial Select Sector SPDR Fund (XLF). Unlike XLK, it recently broke out on a gap up move. Then it retested the breakout…and the 20-day EMA…and held. All of the major moving averages are still climbing, and RSI is stair-stepping higher along with the ETF.

Financial Select Sector SPDR Fund (XLF)

Source: StockCharts

Financials are a cornerstone sector. Financial stocks typically falter when economic and credit concerns pile up. But they aren’t. Instead, shares of banks, brokers, insurers, and other similar companies are doing just fine – helped along by the fact the Treasury yield curve is steepening.

Bottom line? Companies in the XLF may not be as sexy as companies in the XLK. They may not get as much media attention.

But if they keep rallying – and tech stocks just mark time – I’m fine with the “trade.” If you’re a market bull, you should be, too!