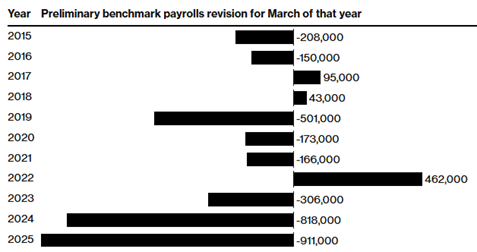

Benchmark revision. The term sounds so anodyne. Harmless really. But thanks to the latest such revision at the Bureau of Labor Statistics, it turns out 911,000 US jobs just went…Poof!

First, some background. The BLS reports employment and unemployment figures each month based on business and household surveys it conducts. Those figures get revised as additional data comes in past the initial deadline. Then each year, the bureau also uses more-complete, delayed data to adjust previously reported numbers. Those revisions cover 12 months of figures ending each March.

Now, take a look at the MoneyShow Chart of the Day, which comes from Bloomberg. You can see that the revisions have gotten larger and larger in the wake of the Covid-19 pandemic – and that the estimated 2025 revision was ENORMOUS.

Source: Bloomberg

The BLS blamed a couple of factors for the large change, including discrepancies between what businesses said in survey responses and what they reported in tax filings. But from an investor standpoint, it doesn’t really matter. What matters is that this only INCREASES the likelihood of Federal Reserve interest rate cuts – while simultaneously raising questions about the health of the US economy.

Consider this: Average monthly job gains previously came in at 147,000 over the 12-month period. If these figures aren’t modified in the FINAL round of revisions due in February 2026, that means the economy created less than HALF as many jobs on average as previously thought. The more-recent numbers are even worse.

Bottom line? Get ready for an initial cut from the Fed a week from today. Then look for even more in the months ahead.