Valued at $6.6 billion, Affiliated Managers Group Inc. (AMG) is a global asset management company with equity investments in leading boutique investment management firms. Since the Trend Seeker tool signaled a “Buy” on AMG May 7, the stock has gained 36%, highlights Jim Van Meerten, analyst at Barchart.

AMG’s affiliates offer many investment products across a broad array of active, alpha-oriented strategies to both institutional and retail clients around the world. So, AMG shares offer investors a unique opportunity to participate in the growth of a diverse group of high-quality boutique investment management firms.

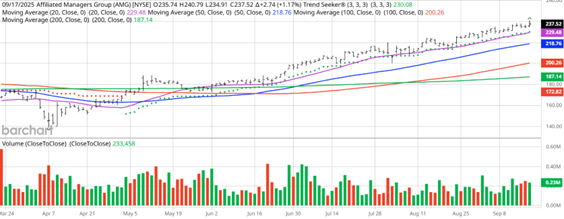

AMG Price vs. Daily Moving Averages

The stock hit a new all-time high of $240.79 on Sept. 17. It has a Weighted Alpha of +44.1, a 100% “Buy” opinion from Barchart, and it’s trading above its 20-, 50-, and 100-day moving averages. AMG also made 13 new highs in the last month and sports a Relative Strength Index (RSI) of 72.2%.

Meanwhile, it looks like Wall Street analysts are high on Affiliated Managers. Those tracked by Barchart have issued seven “Strong Buy” ratings and only one “Strong Sell” opinion. Their price targets are between $210-$331. Value Line gives the stock its “Above Average” rating with a price target of $260, while CFRA’s MarketScope Advisor rates it a “Buy.”

AMG seems to have it all – growth in both revenue and earnings and a wide following by individual and institutional investors. But the stock is volatile and even speculative in the current environment, which means investors should use strict risk management and stop-loss strategies.