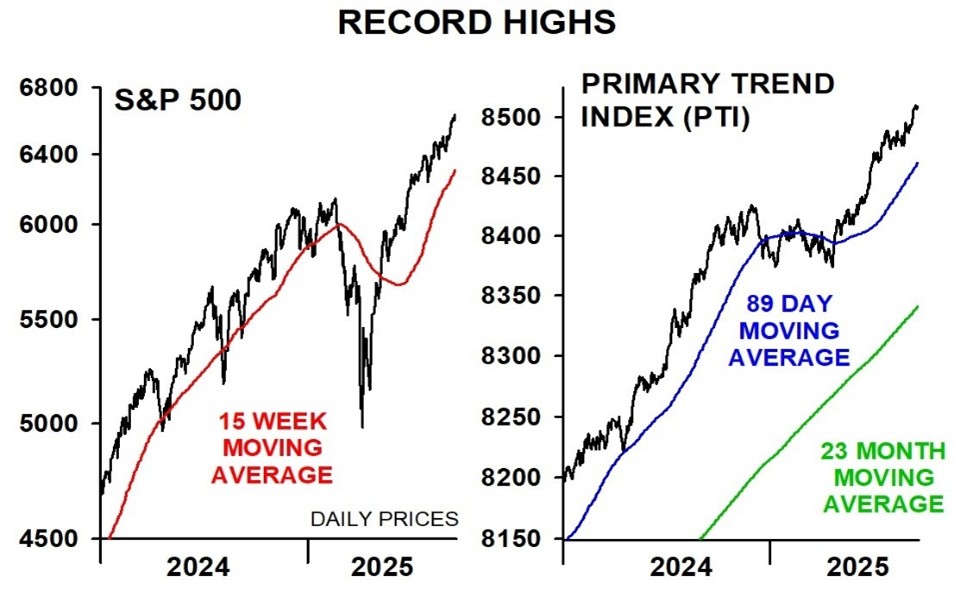

The stock market is hitting new record highs. The market thrives on low interest rates, and it’s set to rise further for the time being. Meanwhile, resource shares and metals are generally holding firm – and the dollar will likely head much lower as the downtrend intensifies, advise Mary Anne and Pamela Aden, editors of The Aden Forecast.

Despite renewed strength in the S&P 500 Index (^SPX), the Dow Jones Transportation Average is still sluggish and lagging way behind the others. This may be a warning, especially considering that the stock market is the most expensive ever. This alone means risk is high, which is why we advise staying on the sidelines.

Meanwhile, silver hit a new high last Monday, and it’ll stay strong above $39. A rise above $43 would signal that silver is on its way to $50. Gold shares are super strong. They’ll stay that way with the HUI Index above 470.

The US Dollar Index declined last week. It was already under downward pressure due to the likelihood of lower rates. But now that the Fed has opened the door to lower rates ahead, the dollar will likely head much lower as the downtrend intensifies.

At the same time, this is putting upward pressure on the major foreign currencies. They’re poised to rise further, with the Swiss franc the strongest.