Many global markets are beating the pants off the SPDR S&P 500 ETF (SPY) this year. But which ones look the MOST attractive? I just had the privilege of chatting with Dr. Mark Mobius – the “Godfather of Emerging Markets” – on that exact topic. And you’re going to find what he said incredibly enlightening.

First, some background: Mark is chairman of the Mobius Emerging Opportunities Fund. He has visited more than 110 countries – and logged a million-plus miles – during his illustrious global investing career. He has also written a dozen books on investing and economics, including Passport to Profits and Invest for Good: A Healthier World and a Wealthier You.

When I caught up with him earlier this week, he was in Dubai. He had also recently returned from a two-month stint in Japan – where among other things, he visited a sumo school in Osaka (you can check out his blog for investing insights gleaned during that trip).

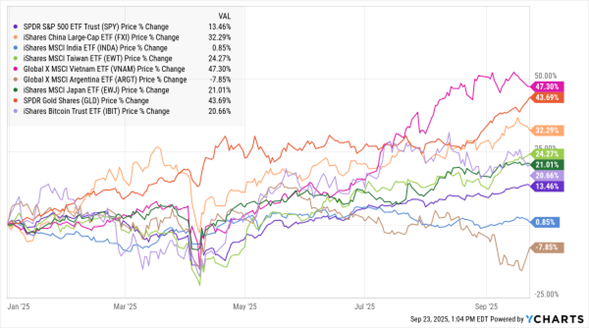

Investing Globally Has Paid Off Handsomely in 2025

(Ditto for Gold & Bitcoin!)

Data by YCharts

Our conversation amounted to a tour around the world – with stops in China, India, Taiwan, Japan, and Vietnam. He explained why those are some of his favorite places to invest now, despite concerns about rising tariffs and the H1-B fee policy just announced by the Trump Administration.

A quick glance at the MoneyShow Chart of the Day shows how that strategy has paid off handsomely. Most US-traded ETFs focused on those countries are easily eclipsing the SPY, with the Global X MSCI Vietnam ETF (VNAM) leading the way at +47.3% year-to-date. Only the iShares MSCI India ETF (INDA) is lagging with a return of 0.8%.

Mobius also spoke about why gold and cryptocurrencies make solid hedges against a long-term dollar decline (And yes, they’re beating the S&P, too). Plus, he weighed in on the recent market turmoil in Argentina, the investment implications of rising European defense spending, and the one thing investors REALLY need to pay attention to as we head into 2026.

You can catch the full interview in this week’s MoneyShow MoneyMasters Podcast episode, which drops Thursday, Sept. 25 on our YouTube channel. But here’s one key takeaway for now: Don’t let your hunt for promising investments stop at the US border. A world of profit opportunities is waiting out there!