Defense is big business in 2025 thanks to the ratcheting up of geopolitical tensions globally. But US contractors aren’t leading the way when it comes to stock market PERFORMANCE. European contractors are the ones playing offense!

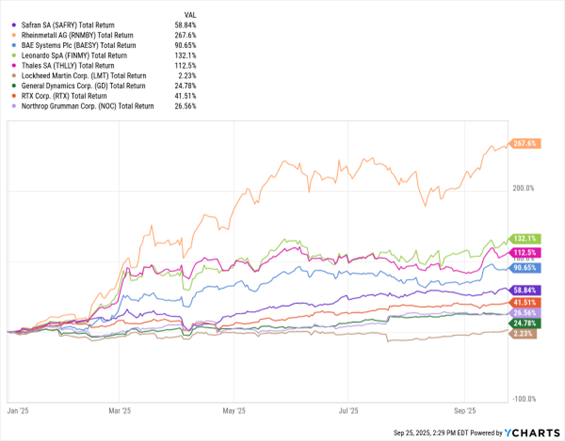

Just look at the MoneyShow Chart of the Day here. It shows that leading US suppliers of everything from missiles and fighter jets to tanks and nuclear submarines are generally performing well. Stocks like General Dynamics Corp. (GD) and RTX Corp. (RTX) are up 24.7% and 41.5%, respectively, so far this year -- with only Lockheed Martin Corp. (LMT) truly lagging at plus-2.2%.

When it Comes to Defense, European Contractors are Playing Offense!

Data by YCharts

But get a load of the US-traded shares of top contractors based in the UK, France, Germany, and Italy. Safran SA (SAFRY)? Up 58.8%. BAE Systems Plc (BAESY)? Up 90.6%. Then you have names like Leonardo SpA (FINMY) and Rheinmetall AG (RNMBY) surging 132.1% and 267.6%!

What’s driving the outperformance? President Trump’s approach toward NATO and the defense of Europe differs from the approach of his predecessors. That has encouraged European countries to ramp up their own defense spending plans.

The ongoing Russia-Ukraine war is right at Western Europe’s doorstep, too, adding urgency to those efforts. Plus, recent alleged Russian drone and fighter jet incursions into the airspace of countries like Estonia, Poland, and Denmark are ratcheting tensions up even higher.

Dr. Mark Mobius talked about European defense ETFs as an investment to consider in this week’s MoneyShow MoneyMasters Podcast. The Select STOXX Europe Aerospace & Defense ETF (EUAD) is one you might consider because it owns all the stocks mentioned earlier. We all wish it was a less-dangerous world. But that just isn’t the case. The performance of European defense stocks reflects that.