The US dollar often finds itself at the center of global financial chess. Today, it occupies a curious “dual” position: Whether the Federal Reserve moves to cut interest rates or falls behind the curve, the dollar plays a pivotal role in shaping capital flows, inflation expectations, and commodity markets, advises Buff Dormeier, chief technical analyst at Kingsview Partners.

The Fed just cut rates by 25 basis points. While the action is aimed at easing financial conditions, cuts are often deemed inflationary, stoking fears of renewed price pressures. In this environment where the dollar direction reverberates across all asset classes, global capital frequently seeks refuge in the dollar, the world’s deepest and most-liquid reserve currency.

Thus, even as yields fall or if spreads widen, inflation worries can paradoxically strengthen the greenback. In this scenario, the dollar’s resilience stems not from higher rates but from its unique role as the cornerstone of global liquidity.

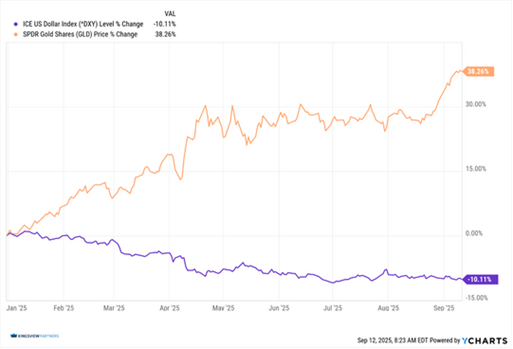

Data by YCharts

On the other hand, should the Fed lag behind the curve (cutting too late or too timidly), the dollar may weaken. A softer dollar cheapens foreign currency access to US assets but also diminishes confidence in the currency itself.

Historically, weak-dollar environments have favored international equities while amplifying the appeal of hard assets. Gold, priced in dollars, becomes more attractive under such conditions. Indeed, commodities and precious metals benefit directly from a declining dollar, particularly when paired with global uncertainty and rising central bank demand.

The numbers tell the story. Year-to-date through mid-September, the ICE US Dollar Index (DXY) has declined over 10%, while the SPDR Gold Shares (GLD) has surged more than 38%.