I’m writing this piece BEFORE I know whether the government will shut down. You’ll read it AFTER the news is out. But that caveat aside, I have a key trader takeaway for “Shutdown Dramas” like this week’s that you’ll REALLY want to remember.

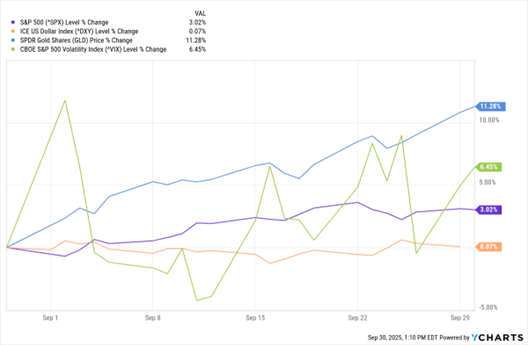

Let’s start with this MoneyShow Chart of the Day. It shows what the S&P 500 Index (^SPX), US Dollar Index, SPDR Gold Shares (GLD), and CBOE Volatility Index (^VIX) did in the month leading up to this morning’s 12:01 am shutdown deadline.

If There’s “Panic” Here, I’m Not Seeing it

Data by YCharts

Forget the headlines for a minute, look at the market action in September, and what can you conclude? That investors weren’t all that worked up about the shutdown in the first place!

Sure, the VIX climbed a BIT. But it didn’t soar. Stocks posted modest gains. The dollar marked time. And while gold surged, that’s nothing new. Precious metals have been surging for the better part of 18 months for a whole host of other reasons.

What gives? Long-term investors know that many threatened shutdowns never actually happen! Last-minute deals often get reached. They also know that when shutdowns happen, they tend not to last very long.

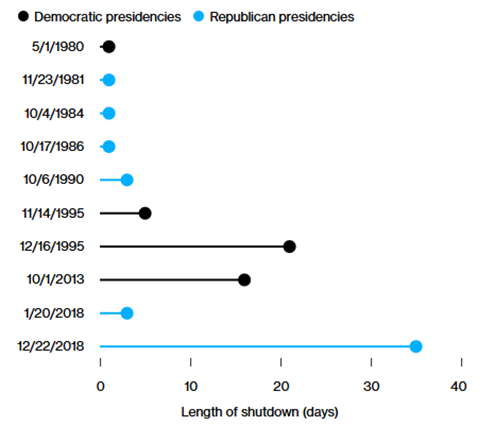

Look at this second MoneyShow Chart of the Day (courtesy of Bloomberg). Under both Democratic and Republican administrations, most shutdowns have lasted only a few days – or a couple of weeks at the outside.

Even When Shutdowns DO Happen, They Usually DON'T Last Very Long

Source: Bloomberg

I’m not denying that shutdowns cause problems. They do. Federal workers get furloughed. Lives get disrupted. Some government operations cease. Economic reports get delayed.

BUT the capital markets often shrug because earnings don’t collapse. The economy takes a modest hit, but it doesn’t collapse, either. In other words, traders take it all in stride (as this digest item from MoneyFlows co-founder Lucas Downey recently chronicled).

So, my point is simple. Don’t panic. Don’t overreact. Stick with your investing or trading plan. In fact, it’s probably better I DON’T know how things will work out…because the data shows it’s not worth worrying about and dumping stocks regardless.