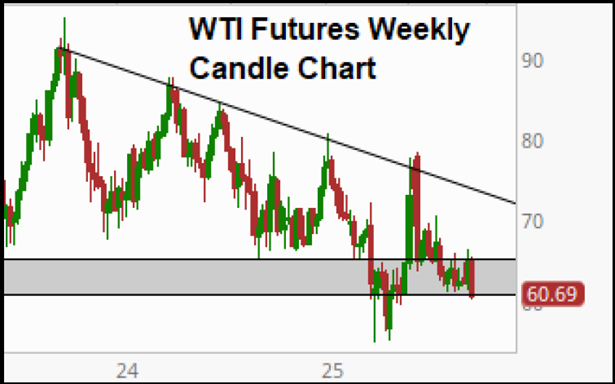

Commodities have been trading with a downside bias recently as easing geopolitical tensions in the Middle East weighed heavily on the oil market. But the primary trend for WTI crude has been bearish since August 2024, notes Tom Essaye, president of the Sevens Report.

The ceasefire news marked a material de-escalation in the Middle East, which has been ravaged by military conflict for over two years. On the charts, near-term technical support between $60 and $61 per barrel in WTI futures is intact. It should be looked at as a key “line in the sand” for the oil bulls here. A break below would likely see a quick follow-through selloff towards the next important support level at $57/barrel.

On a longer-time horizon, the threat of a sizeable physical market surplus emerging in the quarters ahead due to OPEC+ production increases, near-record output in the US, and potentially waning global demand leave price risks skewed to the downside in the energy complex. However, with a crowded bearish sentiment camp, oil prices are mechanically susceptible to a short-squeeze should any bullish near-term surprises or developments emerge.

Key resistance levels are: $61.38, $62.30, and $63.64. Key support levels are: $60.40, $59.00, and $57.23.