Today’s piece focuses on a lumber products company, UFP Industries Inc. (UFPI). Like many of its peers, UFPI has had a tough 2025, observes Jim Van Meerten, analyst at Barchart.

The company supplies wood and wood composite to retail, industrial, and construction markets. Across these three buckets, UFP supports everyone from do-it-yourself homeowners to homebuilders and RV makers. The company said on its Q2 earnings call that it continues to face “ongoing soft end market demand and competitive pricing pressures.”

This comes as lumber (LBX25) prices have been under pressure, with futures prices down more than 10% over the past three months. Trade uncertainty, with 10% tariffs on most imported lumber products, and housing market weakness, have hit demand for lumber.

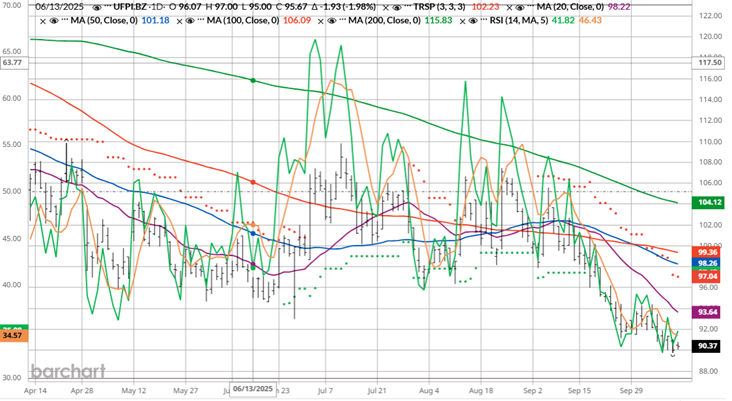

We typically find our Chart of the Day features by using Barchart’s powerful screening functions to sort for stocks with the highest technical buy signals, superior current momentum in both strength and direction, and a Trend Seeker “buy” signal. Today’s feature is the opposite. The Trend Seeker signaled a new “Sell” on Sept. 17.

UFPI Price vs. Daily Moving Averages

UFPI hit a two-year low of $89.76 in intraday trading on Oct. 9. The stock has a Weighted Alpha of -33.45 and a 100% “Sell” opinion from Barchart. It has lost 32.7% over the past year.

Fundamentally, revenue is projected to decline 2.6% this year before gaining 4.3% next year. Earnings are projected to decline 17.1% this year before gaining 15% next year. The Wall Street analysts tracked by Barchart have issued only two “Strong Buy” ratings, plus four “Hold” ratings and one “Strong Sell.”

Bottom line: Universal Forest Products is caught up in several macroeconomic headwinds. From a technical standpoint, its RSI has been trending lower, but still remains above the “oversold” threshold at 30. With analysts forecasting negative earnings and revenue for 2025, and Barchart’s indicators flashing red, the turnaround story in this lumber stock is likely still a ways away.