Copper tends to make a major seasonal bottom in November/December and then tends to post major seasonal peaks in April or May. One trading option that provides exposure to the copper market without having to have a futures trading account is the United States Copper Index Fund (CPER), advises Jeff Hirsch, editor-in-chief of The Stock Trader’s Almanac.

This pattern could be due to the buildup of inventories by miners and manufacturers as the construction season begins in late winter to early spring. Automakers are also preparing for the new car model year that often begins in mid-to-late summer. After getting hit by a 50% tariff at the end of July, copper has rebounded and appears to be beginning its historically favorable season early this year.

Futures traders can consider going long a May 2026 futures contract on or about Dec. 12 and hold until around late February. In this trade’s 53-year history, it has worked 35 times for a success rate of 66%. The average gain in all years is 5.4%. Last year, copper did hit a seasonal low in November, then bounced and retested the low in January, before shooting higher until the end of March.

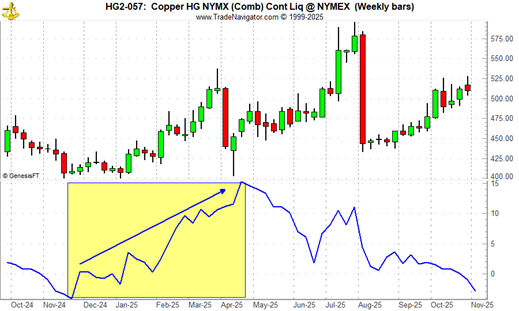

In the chart here, the front-month copper futures weekly price moves (top pane), and seasonal pattern (bottom pane) are plotted. Typical seasonal strength in copper is depicted by a blue arrow and yellow shading in the lower pane of the chart. Last year’s seasonal period is visible in the top pane of the chart.

As for CPER, this ETF tracks the daily performance of the SummerHaven Copper Index Total Return less fund expenses. Due to renewed interest in copper, CPER’s daily volume has improved, and it frequently trades in excess of 500,000 shares per day. Stochastic, relative strength, and MACD technical indicators applied to CPER are all positive and trending higher.

Recommended Action: Buy CPER.