Last week, the S&P 500 Index (^SPX) closed with a rare “Gravestone Doji.” In Japanese candlestick analysis, the Gravestone Doji represents a failed rally and the potential “death” of an uptrend. For traders, this might be a time to tighten formation, advises Buff Dormeier, chief technical analyst at Kingsview Partners.

It is a potential warning that buyers lost their grip and that selling pressure may soon overtake demand. This rare formation occurred even as the price index made new all-time weekly and intraday highs on high trading volume – creating a strangely wrapped nugget for trick or treaters to consider.

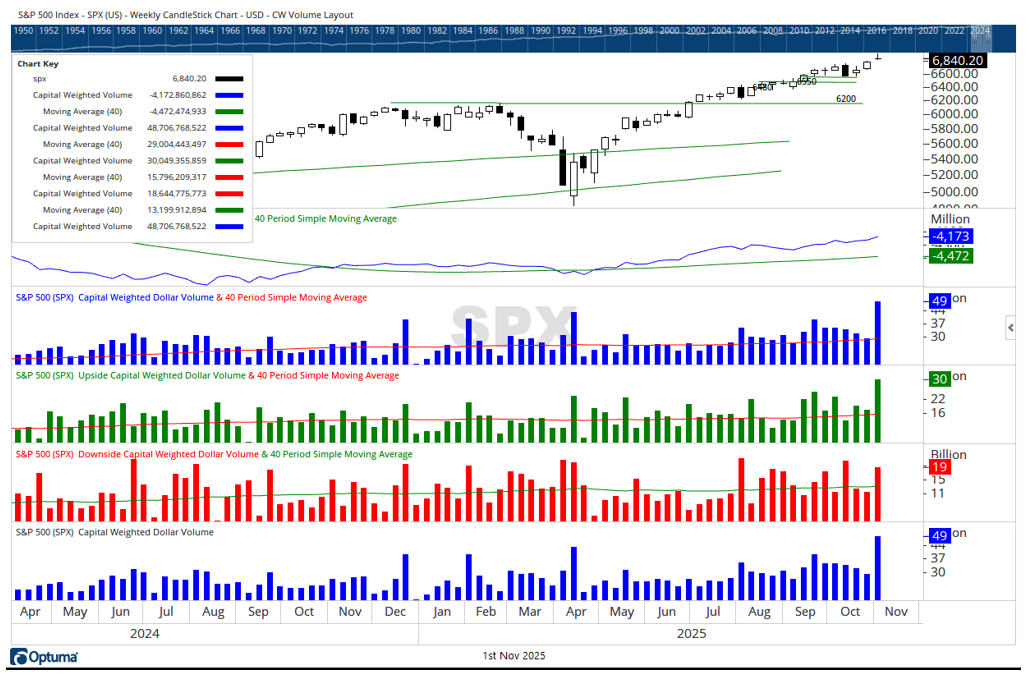

S&P 500 Index (SPX)

The market opened with an upside gap above prior highs, surged intraday to fresh records, then reversed lower, closing near the weekly open as well as the low. Volume was exceptionally high, suggesting emotional participation from both breakout buyers and profit-taking sellers.

The S&P 500’s upside gap reflected strong bullish conviction, possibly even a degree of panic buying. Yet by the close, those ghostly gains mostly evaporated, perhaps revealing institutional distribution. The long upper wick reflected exhaustion, where early demand was eventually mostly absorbed by supply.

Meanwhile, volume continues to rise, even from the grave. On the week, capital-weighted volume was highly elevated, with 64% of capital-weighted activity to the upside. Dollar-weighted volume was an historic standout.

More capital traded hands last week than in any prior week on record, even surpassing the high-volume rebound of April 11. Total and capital inflows were exceedingly strong, while downside flows rose back to average levels.

For traders, this might be a time to tighten formations, reaffirm risk parameters, rebalance exposure, and ensure a disciplined defense remains in place. As in any campaign, victories are preserved not by unchecked advance, but by prudent management of position, terrain, and supply lines.

In investing terms: position sizing, diversification, and adaptive risk management are our lines of defense when gaps and ghosts may haunt the market’s summit.