The big-cap indexes have been leading for a while now. But more recently, we’ve seen an even greater dichotomy out there, with the broad market actually coming under pressure. Meanwhile, our top pick is Cloudflare Inc. (NET), which is getting going from a two-and-a-half-month rest following another great quarterly report, writes Mike Cintolo, editor of Cabot Top Ten Trader.

New lows are elevated and greater than new highs, with most (non-big-cap) indexes testing or breaking intermediate-term support. On the flip side, though, there are still some good-sized pockets of strength out there. In fact, while earnings season isn’t over yet, the number of growth-y stocks in good shape has actually increased.

These sorts of divergences tell us the risk of some unpleasantness (be that an across-the-board correction or a sudden rotation into the beaten-down broad market) has increased, though that doesn’t guarantee it will happen and, if it does, when. Thus, it’s best to go with the flow right here — aiming to buy strong, fresh leaders at decent entry points.

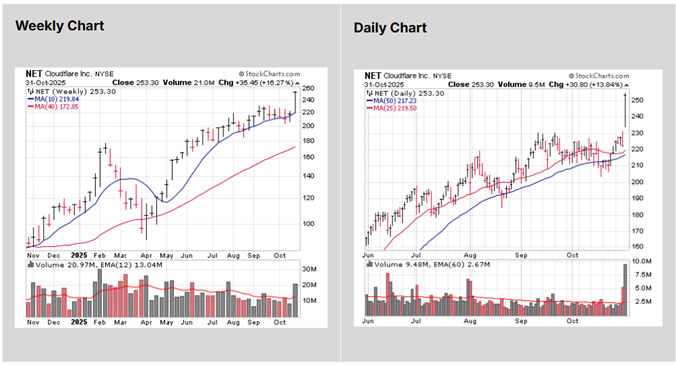

NET’s comeback from its big, early-year, market-induced pullback was excellent – soaring nine weeks in a row to new highs right quick. From there, it stepped its way higher but started to hit some resistance in early August. While there was a minor new high in September, NET dipped again and ended up with no net progress for two and a half months.

But now shares are free-wheeling again, with new price and relative-performance peaks. We’re okay grabbing some here with a stop under 220.

Recommended Action: Buy NET.