I read a LOT of research – and watch a LOT of market hot takes. But the “Dollar Doomsday” scenario that RBC Capital Markets just laid out really grabbed my attention.

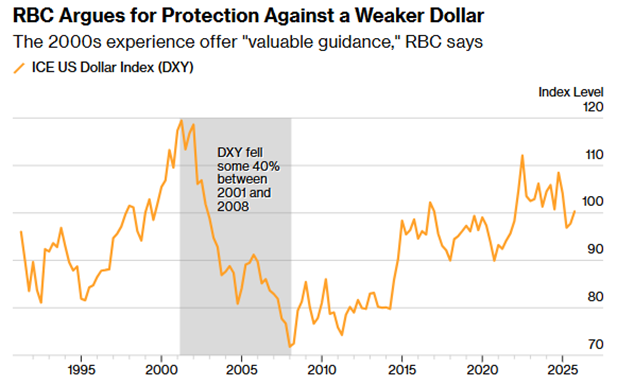

Check out this MoneyShow Chart of the Day, courtesy of Bloomberg. It shows what happened to the ICE US Dollar Index in the wake of the Dot-Com bust – and RBC says investors should be ready for a replay in the years ahead!

Source: Bloomberg

Why? Currency strategist Richard Cochinos says that passively managed global investment funds have piled into US stocks over the last several years, driving up their value and driving massive inflows into the dollar. But he believes we could see a “measurable change in demand” for US assets, leading to a dollar decline similar to the 40% peak-to-trough slump from 2001 to 2008.

That’s aggressive, out-of-the-box thinking. But is it RIGHT?

I’m on record expecting a dollar decline, for reasons I’ve laid out before in columns and in person at MoneyShow events. You can brush up on my thesis here if you want. But we haven’t broken the technical levels I’ve been watching (yet).

Plus, a 40% plunge is much more severe than you typically see in forex markets. It’s more akin to what Peter Schiff, chief global strategist at Euro Pacific Asset Management, has warned about – including in this MoneyShow MoneyMasters Podcast episode from August.

So, at the very least, you might want to wait until we get breakdown confirmation before TRADING the move. If you want to INVEST in a long-term dollar decline, there are a wide range of ETFs and other strategies you can use. That includes buying precious metals like gold and silver, which tend to outperform when the dollar falls.