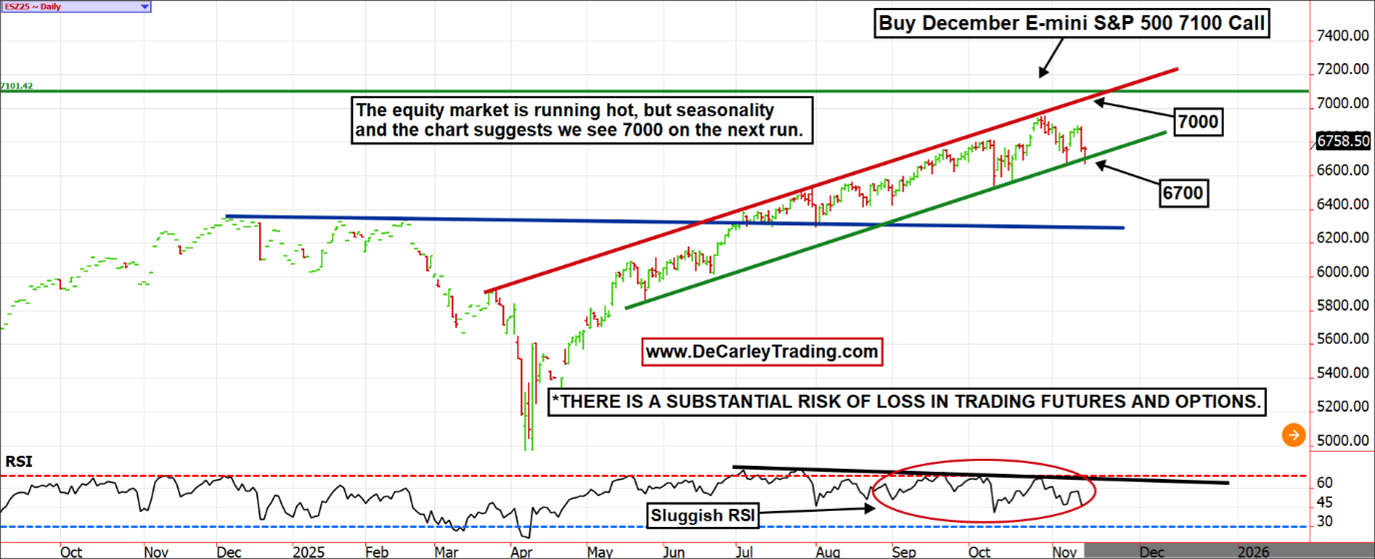

We aren't bullish on the stock market, but even amid the financial crisis, stocks rallied over the holiday season. Buying a cheap call option comes with limited risk, so if we are wrong and the tides turn early, it won't be a bank-breaker, notes Carley Garner, senior commodity market strategist and broker at DeCarley Trading.

It is very unusual for large, sustained selling to occur at this time of year, and we have learned that fighting it is a losing battle. However, the recent dip has run some premium off call options, and the recent overnight futures market low appears to be a rejection of selling at the trendline.

(Editor’s Note: Carley will be speaking at the 2026 MoneyShow/TradersEXPO Las Vegas, scheduled for Feb. 23-25. Click HERE to register.)

Thus, if you want to play the upside ahead of what is almost always a seasonal upswing, you can buy a December 7100 call for less than a thousand dollars and sleep well at night.

To clarify, we do believe the market will experience a day of reckoning. But such a move generally happens after the turn of the year (or a little earlier in the case of 2021). Seasonality and charts point toward a new high before such a reversal is possible.