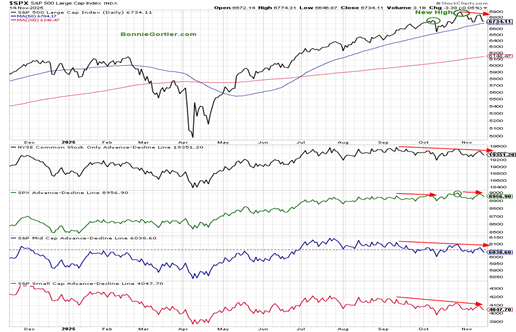

Major US indices experienced their largest one-day decline in over a month recently. The major averages continue to hold support despite an increase in intraday volatility. But market breadth has weakened considerably and is flashing warning signals, writes Bonnie Gortler, CEO of BonnieGortler.com.

The S&P 500 Index (^SPX) reached a new high in October, confirmed by the S&P 500 advance-decline line (third chart below), but not yet in November. It’s worrisome that lower highs in breadth exist in the Common Stock New York Stock Exchange (NYSE), the S&P MidCap, and the S&P Small Cap Advance-Decline Line.

S&P 500 Index (^SPX)

If there is no confirmation, the rally will continue to narrow. That will make it harder to make money, and a more significant pullback could occur.

Investor sentiment, as measured by the Fear and Greed Index (a contrarian indicator), closed at 22 recently. That represented “Extreme Fear” despite the fact major averages were trading near all-time highs. Many times, when markets are in the extreme-fear zone, good buying opportunities arise.

But if there is no improvement in breadth, it could set the stage for a short-term pullback despite a long-term cycle bottom in the Nasdaq 100. The fourth quarter is typically the best of the year.

Continue to give the benefit of the doubt to the bulls, but prioritize reviewing your portfolio if support levels do not hold. Manage your risk and your wealth will grow.