The ultimate power law in markets is supply and demand. When institutions slow down purchases, stocks fall. So, when will the market selloff end? You first need perspective on the current landscape as a trader, says Lucas Downey, co-founder of MoneyFlows.

One of the easiest ways to visualize the trend of money flows is with the Big Money Index (BMI). It’s our North Star. When the line of truth is falling, it indicates that inflows are slowing and outflows are growing. It now sits at 46%, the lowest reading since late April.

Inside of all this carnage is a clear theme. Most mega-cap tech stocks are in correction territory -- off double digits from their recent peaks. So, if your portfolio is down, just know it’s a broad-based pullback. Now the million-dollar question is simple: When will the market selloff end?

To find an answer, let’s turn to cold hard data. And there is good news. That’s because the low-level BMI is approaching a level forecasting better-than-average market returns.

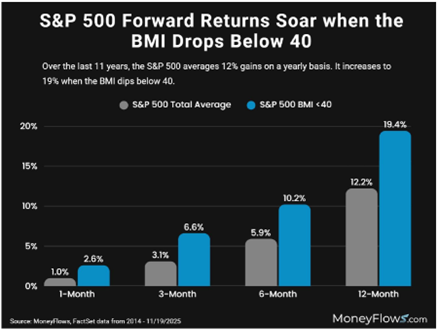

To prove this, consider that we’ve been in business for 11 years. We’ve seen a lot in that decade-plus timeframe: a few bear markets and multiple crowd-stunning rallies. The current BMI sits at 46%. I went back and studied how the S&P 500 Index (^SPX) performs on average after each month, three-month, six-month, and 12-month period.

It may not surprise you to learn that the market gains an average of 12% each year. However, the average gains jump massively when the BMI falls below 40% as evidenced by the chart above. You want to be constructive on stocks as we approach the 40% line because the average forward returns nearly double the market in each timeframe.

But how can we time the market low? That comes down to spotting capitulation. Our unique data helps you see forced selling in real-time. How do we define capitulation? It’s roughly 400 equity outflows in a session. That amounts to nearly 30% of our institutionally traded universe. These rare signals are defined as a Forced Capitulation Trigger (FCT).