Not so long ago (Oct. 10), I wrote about how some credit-sensitive stocks were stumbling. That stumble is now turning into a swoon – and that’s helping sink stocks.

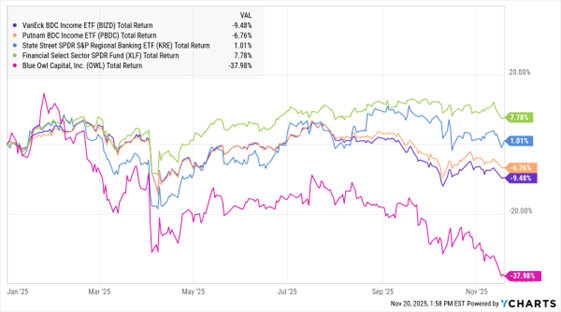

Just look at this week’s MoneyShow Chart of the Day, which is an updated and modified version of the chart I shared in mid-October. It shows the performance of ETFs that track Business Development Companies (BDCs) and the broader financial sector. I also threw in one additional individual stock, Blue Owl Capital Inc. (OWL). It’s an alternative asset manager and bellwether for the private credit market.

BDC Stocks – No, Things are NOT Getting Better

Data by YCharts

Things aren’t getting better, clearly. They’re getting worse. The VanEck BDC Income ETF (BIZD) is now down 9.4% on the year. The State Street SPDR S&P Regional Banking ETF (KRE) is roughly flat. As for OWL, what can I say? It’s now off 38% year-to-date, having taken out its spring low recently.

The issue goes back to credit risk. Investors are growing increasingly concerned that private credit firms have been too aggressive lending money the last few years. With the economy slowing and delinquencies rising in select industries, they’re worried more and more proverbial shoes are going to drop.

Then there’s Oracle Corp. (ORCL), the stock I wrote about back on Nov. 10. It was one of the hottest Artificial Intelligence (AI) stocks for a while, but it has done nothing but sell off lately. Meanwhile, in the derivatives market, the cost of insuring Oracle bonds using Credit Default Swaps (CDS) has surged. Translation: Credit worries are percolating in the AI world as well.

We still have seasonality going for us. We still have modestly favorable Federal Reserve policy. But if there’s one thing I’ve learned in my almost-three-decade long career analyzing and writing about markets, it’s that you do NOT want to ignore credit markets. And what I’m seeing there is increasingly troublesome.