The federal government is back to work. But the backlog of economic data is still being worked through. Meanwhile, one new private report from ADP Research suggests the labor market could use a stronger pulse.

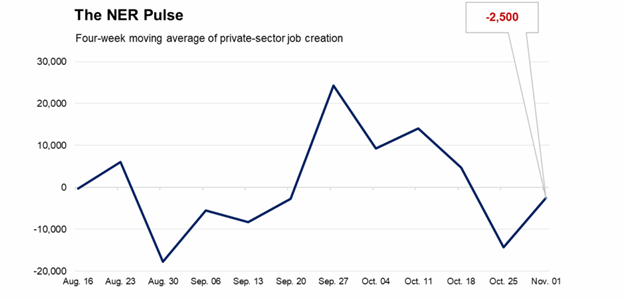

Take a look at the MoneyShow Chart of the Day. It shows the “NER Pulse” – a new report showing a running estimate of the week-over-week change in US employment. It’s one of the indicators investors are watching to gauge the strength of the economy and labor market in the absence of official data. As you can see, the chart doesn’t look great.

The Job Market Could Use a Stronger Pulse

Source: ADP Payroll Data

In the four weeks ending Nov. 1, non-public employers were shedding an estimated 2,500 jobs each week. That’s a big shift from what we saw back in September, when the running tally was in the 10,000-20,000 GAIN range.

A more thorough analysis suggests many retiring workers and other job leavers are being replaced. But companies aren’t increasing headcount overall. That’s why the economy’s overall pulse is weak.

What does it mean for markets…and traders?

On the one hand, weaker job market conditions could prompt the Federal Reserve to cut interest rates again at the Dec. 9-10 meeting. The implied chance of a 25-basis point cut in the federal funds rate in December rose to 82% yesterday. That was up from 50% a week ago, according to CME FedWatch.

On the other hand, too much weakness at an important time of year for consumer spending could be a problem. Sure enough, we just learned the Conference Board’s Consumer Confidence Index dropped 4.3 points to 126.9 in November. That was its lowest reading since April. A subindex tracking consumer expectations has been stuck below 80 for ten months in a row. Readings that low have signaled impending recessions in the past.

So, the Thanksgiving week bounce we’ve seen is nice. But there are some concerning signs in the labor market – and that could lead to a post-holiday consolidation or pullback!