S&P 500 Index (^SPX) support is at 6,825 and 6,800. Resistance is 6,850 and 6,900. The FOMC meeting is the last thing preventing traders from packing it up for the year, and our models show about three vol points associated with this event. That three points of event vol is in the context of SPX IV that is pretty fairly priced, writes Brent Kochuba, founder of SpotGamma.

Should FOMC pass without issue, we imagine that December vol gets smacked, and we start to see ~10% IVs into end-of-year. That would be a lift to stocks, with SPX 7,000 the huge open interest level into end-of-year. The downside path is open to at least 6,700, as we think FOMC-induced anxiety could spark a quick move into the 6,6xxs.

If you are the type playing for a dovish surprise (i.e. most speculatively bullish), we like Dec. 31 to 1-month iShares Russell 2000 ETF (IWM) calls as they scan as some of the cheapest calls you will find. SPDR S&P 500 ETF (SPY), too, show as reasonably priced.

For downside, it of course depends on the move you are trying to play. Puts are overall pretty cheap, particularly if you are buying a short-dated tail move down in the 6,700s. You can do that with OTM put flies, which can give you some decent downside deltas for cheap.

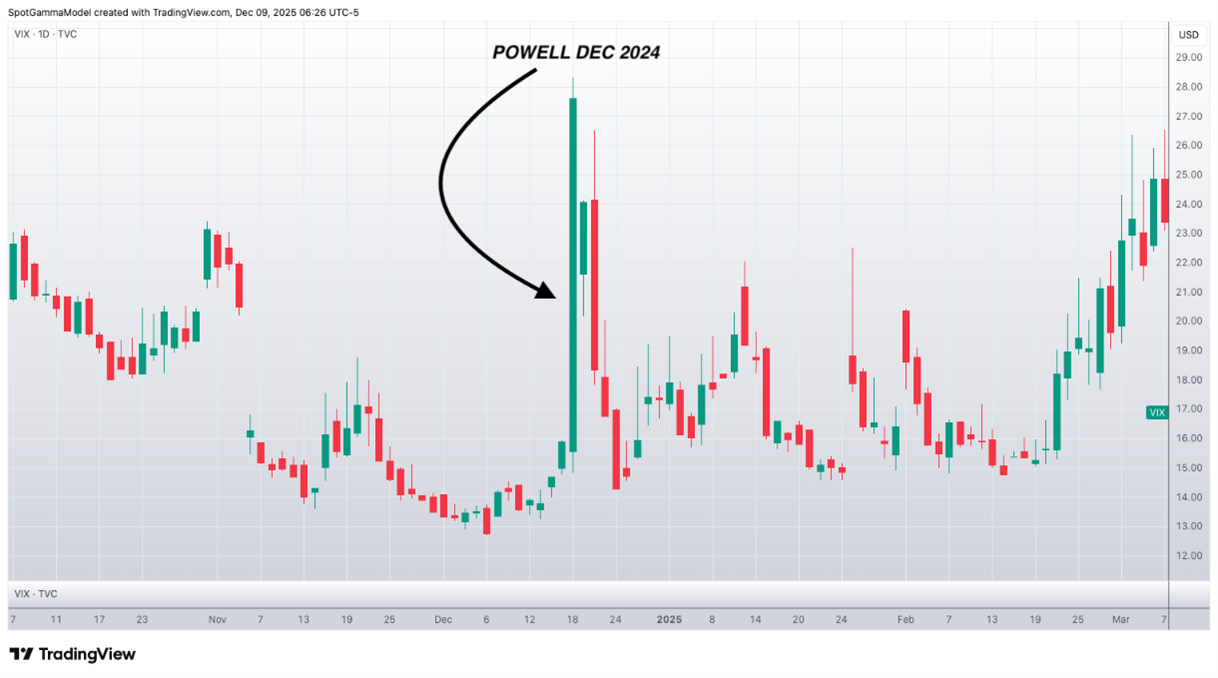

Finally, the “Powell breaks things” view may be best expressed with something like Dec. 17 CBOE Volatility Index (^VIX) 20-30 call spreads, which were recently market at 43 cents. Before you say “VIX 30 sounds crazy,” we present the Dec. 2024 FOMC move above, which saw VIX go from 16 to 28.

We’re not predicting a massive VIX spike out of FOMC. We are simply saying “It’s a possible path,” and short-dated VIX call spreads may be a great risk/reward hedge, particularly if you pair it with an upside equity trade.