Artificial Intelligence (AI) stocks faced heavy selling pressure last week, which became a catalyst for a broader market sell-off on Friday. Although investors have begun to rotate out of technology stocks, tech has fueled the rally in 2025 and it's too early to say this trend is over, writes Bonnie Gortler, CEO of BonnieGortler.com.

Semiconductors and technology ETFs like the Invesco QQQ Trust (QQQ) were sharply lower. Market breadth has improved recently and is no longer flashing negative divergences, implying that any decline is likely short-lived and to be followed by another rally.

This time of year is historically favorable, but expect higher intraday volatility as investors and institutions continue to rebalance their portfolios to adjust risk and make tax-related changes. Until support levels break, the bulls continue to get the benefit of the doubt.

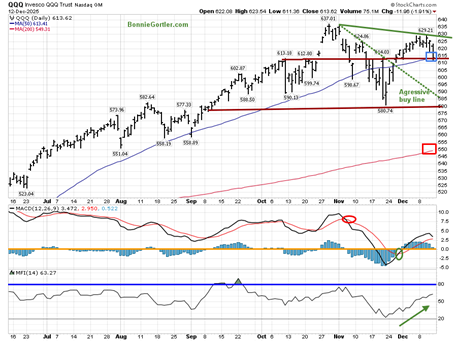

Invesco QQQ Trust (QQQ) – Price (Top), 12-26-9 MACD (Middle),

and Money Flow (Bottom)

Meanwhile, QQQ closed near its low on Friday as investors dumped tech stocks for value stocks. It finished the week down by 1.9% and closed near the first support area (brown line) and the 50-Day MA (blue rectangle). Support is at 597, 590, 580, and 550.