Technical momentum has been building at United Rentals Inc. (URI). The company is the largest rental equipment provider in the world, with a store network nearly three times the size of any other provider, and locations in 49 states and all Canadian provinces, notes John Eade, president of Argus Research.

The company has over 27,000 employees and approximately 1,600 rental locations in the US and Canada. URI shares have outperformed the market over the past five years, gaining 245% while the S&P 500 Index (^SPX) has risen 80%. The shares substantially outperformed the market and the iShares US Industrials ETF (IYJ) over the long term as well.

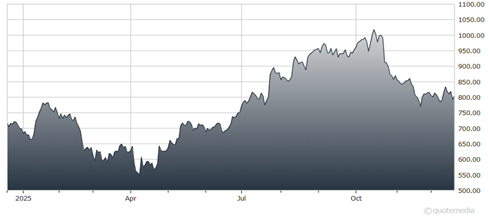

United Rentals Inc. (URI)

Though the shares are in a long-term bullish pattern of higher highs and higher lows, they have pulled back significantly from all-time highs at $1,020 in mid-October. Indeed, URI is approaching 100-day moving average support at $750, and we would set a stop-loss just under that mark.

Resistance may come into play at $975 as the stock moves back towards that all-time high, and that is where we would consider taking some near-term profits.