Semiconductors, specifically those tied to the DRAM bottleneck, have attracted immense inflows for months. Precious metals, specifically silver, have also climbed with powerful demand. But the evidence points to a better bet for semiconductors in the months ahead, writes Lucas Downey, co-founder of MoneyFlows.

New calendar years bring new leaders. Institutional investors deploy capital in hopes of outperforming benchmarks. This is one reason we tend to see wild market moves in early January. Our unique data is laser-focused on outsized volumes…and there’s a lot happening under the surface right now.

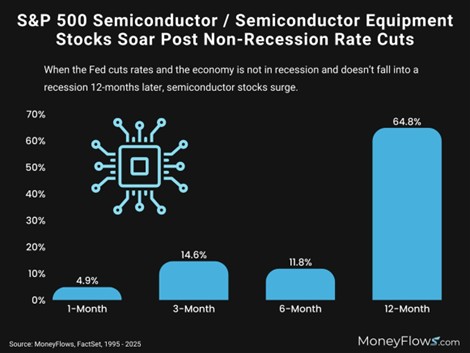

Let’s first tackle semiconductors. If you’re surprised by the enormous rally in semiconductors lately, don’t be. Back in September, we showed how Fed rate cuts will boost the group. The chart here shows how semiconductors power higher when the Fed cuts rates, the economy isn’t in recession, and doesn’t fall into recession 12-months later.

Now let’s pivot to precious metals. Silver has had an epic rise. Without question, those along for the ride have been rewarded handsomely. The iShares Silver Trust (SLV) has gained an astonishing 159% over the past year.

Importantly, much of that gain has come recently. One study in particular is flashing a red light for the commodity. History suggests that now is not a great time to buy the shiny metal.

Consider this: the SLV ETF jumped 62% in the 45 sessions ended Dec. 26, 2025. This is incredibly rare…and forecasts a negative outlook. We were able to find 19 prior instances where SLV gained 50%-plus in 45 sessions. Similar thrusts occurred in 2011 and 2020. Notably in all instances, SLV was lower 12 months later, with an average decline of 17.5%.

Could silver keep gaining from here? Of course. But sizing up both overbought areas, high-quality semiconductors have the edge.