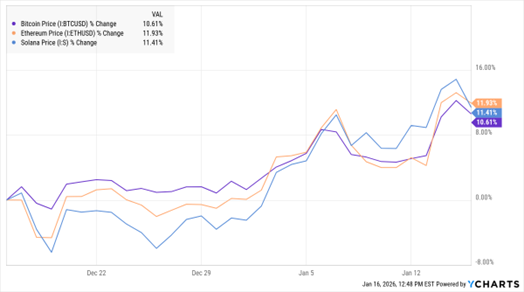

While the S&P 500 Index (^SPX) continues to tease investors with an upside breakout, the S&P 400 and the S&P 600 have marched higher in 2026, hitting all-time highs virtually every day. Cryptocurrencies have also suddenly come to life, observes John Eade, president of Argus Research.

Bitcoin (BTC), Ethereum (ETC), and Solana (SOL) may have completed their bear markets as they are showing key bullish signs for the first time in many months. BTC has broken its downtrend line (DTL) off the peak since Oct. 6. ETC has done the same off its August top. And SOL has taken out the bearish DTL off its September high.

Bitcoin, Ethereum, Solana (1-Mo. % Change)

Data by YCharts

Perhaps of greater importance, we are finally seeing some high-volume institutional accumulation as well as a series of higher highs and higher lows — this after months of high-volume selling. At the same time that crypto is acting better, the US Dollar Index (DXY) has perked up.

DXY is approaching the top of its multi-month base just above the $100 region. A strong rally over $100 could set the stage for a nice move. In the past, intermediate-term greenback strength has not been good news for crypto. But so far, those currencies haven’t flinched.