It happened, folks. Silver prices blew through $100 an ounce for the first time ever in Friday’s session. Meanwhile, gold got within twenty bucks of another big, round number - $5,000 - then topped it today. So…what’s next?

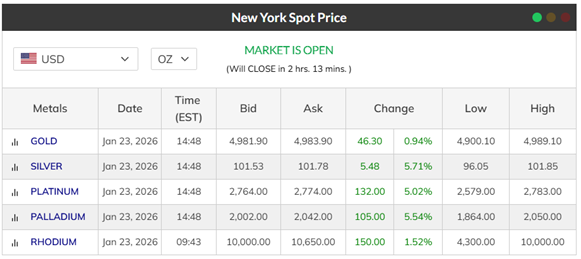

I’ll get to that in a minute. But first, check out the MoneyShow Chart of the Day – or technically, the table of the day. It shows spot prices for both of those metals, plus platinum, palladium, and rhodium, as of Friday afternoon. You can see the rally wasn’t just in silver and gold. Everything was moving!

Spot Precious Metals Prices

Source: Kitco.com

What’s driving the action? Well, I’ve shared my reasons for being bullish many times since I first got on board the precious metals train in H2 2018. Several of our expert contributors have done so, too – including Brien Lundin of Gold Newsletter, Omar Ayales of Gold Charts R Us, and Albert Lu of Luma Financial.

It boils down to the fact investors want protection from currency debasement...rising government debt loads resulting from aggressive borrow-and-spend policies…increasing geopolitical uncertainty in multiple corners of the globe…and elevated equity market volatility. Meanwhile, central banks continue to buy gold as a reserve asset – after previously selling it for years.

We’re going almost parabolic in the short term, which increases the risk of a painful correction out of the blue. Traders should keep that in mind. But for long-term INVESTORS, the forces driving the move look durable to me. If you’re looking for ways to play it, consider the mining stocks you’ll find in our (free) MoneyShow 2026 Top Picks Report HERE.