I didn’t invent the term “SaaS-pocalypse” – but it suits the market vibe to a “T.” Software stocks in particular, and tech stocks in general, are getting hammered. So, is there anything that can turn the tide?

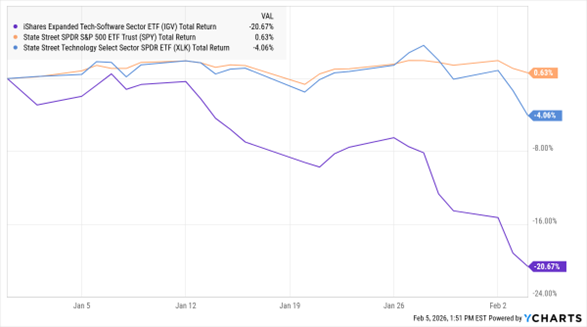

Before I answer that, take a look at my MoneyShow Chart of the Day below. It shows the year-to-date performance of the iShares Expanded Tech-Software Sector ETF (IGV), the State Street Technology Select Sector SPDR ETF (XLK), and the State Street SPDR S&P 500 ETF (SPY).

The short version? Software is radically underperforming the tech sector...and the tech sector is modestly underperforming the S&P 500.

In 2026, Software < Tech < S&P 500

Data by YCharts

That brings me back to the SaaS-pocalypse. The term refers to “Software as a Service” companies, which sell enterprise software that’s periodically updated remotely to large corporations and smaller businesses. It has historically been very profitable. But we’re seeing rapid advances in Artificial Intelligence (AI) tech and tools. That could allow companies to do more work on their own – cutting out SaaS middlemen.

It’s just the latest worry for the tech sector, too. Investors were already antsy over the enormous AI spending bills the hyperscalers are racking up. In fact, Alphabet Inc. (GOOGL) just said it plans a whopping $185 billion in capital expenditures this year. That’s double the amount it spent in 2025 and far above the $119.5 billion analysts expected.

So, again, is there anything that can turn the tide? I shared some thoughts in my MoneyShow Video Market Minute yesterday. But for traders, it comes down to: A) Is sentiment getting too bearish B) Is downside momentum getting exhausted and C) Are valuations getting cheap enough to attract a new base of buyers.

For my money, I think we’re close to satisfying that checklist. Or in plain English, panic-selling now doesn’t look like a smart move...SaaS-pocalypse or not!