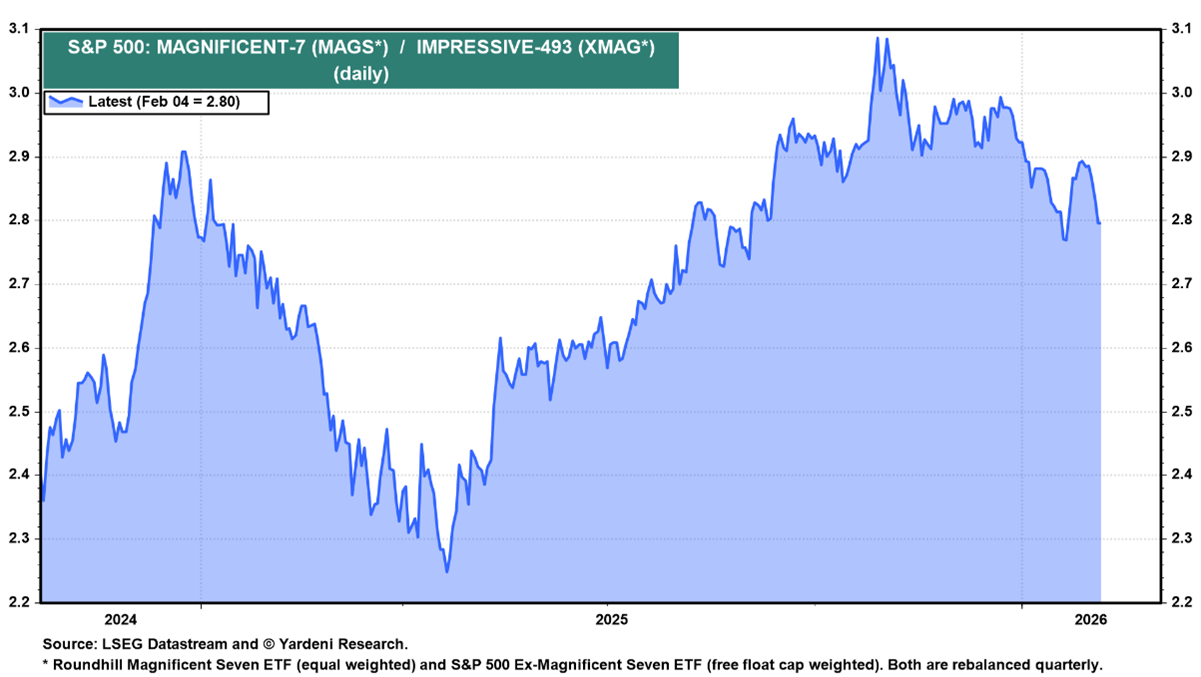

The ratio of the Roundhill Magnificent Seven ETF (MAGS) to the Defiance Large Cap ex-Mag ETF (XMAG) peaked at a record high of 3.09 on Nov. 3, a few days after Michael Burry trashed the AI trade in an Oct. 27 post. It fell to 2.76 last week, notes Ed Yardeni, editor of Yardeni QuickTakes.

In our Dec. 18, 2025 issue, we warned: “The Mag-7 may be undergoing a correction similar to the DeepSeek correction earlier this year…Before AI, the Mag-7 had lots of cash flow because their spending on labor and capital was relatively low. That changed once AI forced them to spend much more on both. They found themselves competing more with one another to win the AI race.”

But the selling of both the Mag-7 and the broad tech sector may be getting a bit overdone. There are certainly AI-related tech stocks that will make lots of money in this space.

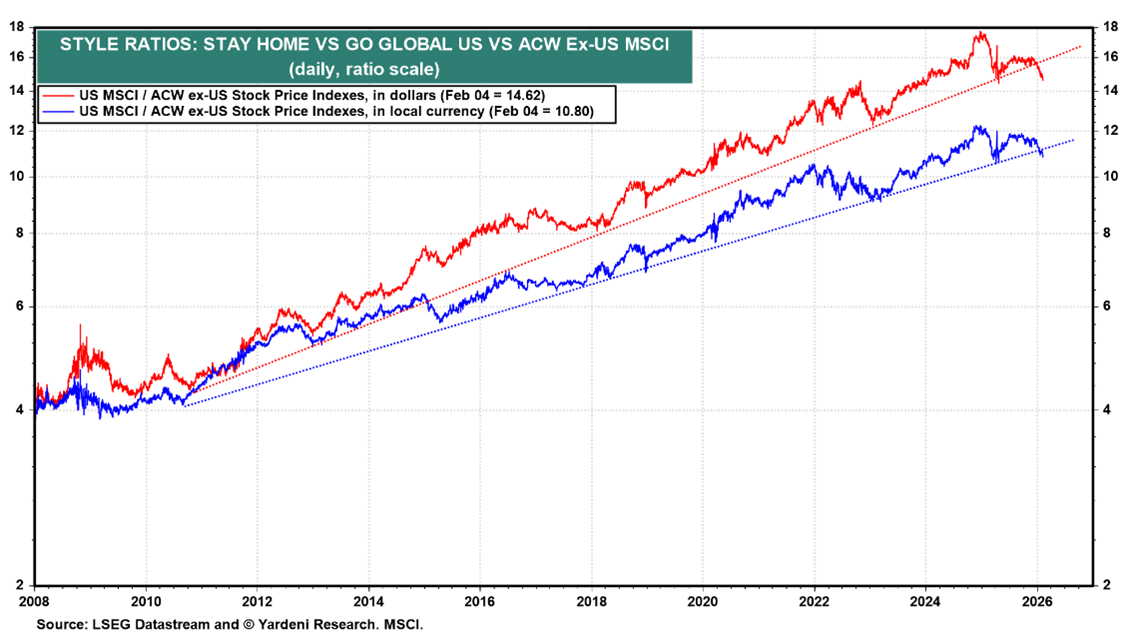

Meanwhile, the underperformance of the Mag-7 and the S&P 500 Information Technology sector is causing the US MSCI to underperform the All Country World ex-US MSCI. On Dec. 7, 2025, we switched our equities strategy recommendation from Stay Home to Go Global.