When it comes to put-buying, we see names “going convex.” To place this into context, the S&P 500 Index (^SPX) was recently 3% off of all-time highs, which were set just a few days ago. But suddenly, the world is a disaster and we see certain subsectors getting absolutely wrecked (software, crypto, etc.), observes Brent Kochuba, founder of SpotGamma.

For the S&P, 6,900 is resistance, with support at 6,800 and 6,740. Then we start to look at the 6,600s “washout” level. TLDR: the smoke hasn't cleared, and we see no reason to get long this market for anything outside of a day trade. We want to see negative gamma reduce before dipping our toes in the water.

(Editor’s Note: Brent is speaking at the 2026 MoneyShow/TradersEXPO Las Vegas, scheduled for Feb. 23-25. Click HERE to register.)

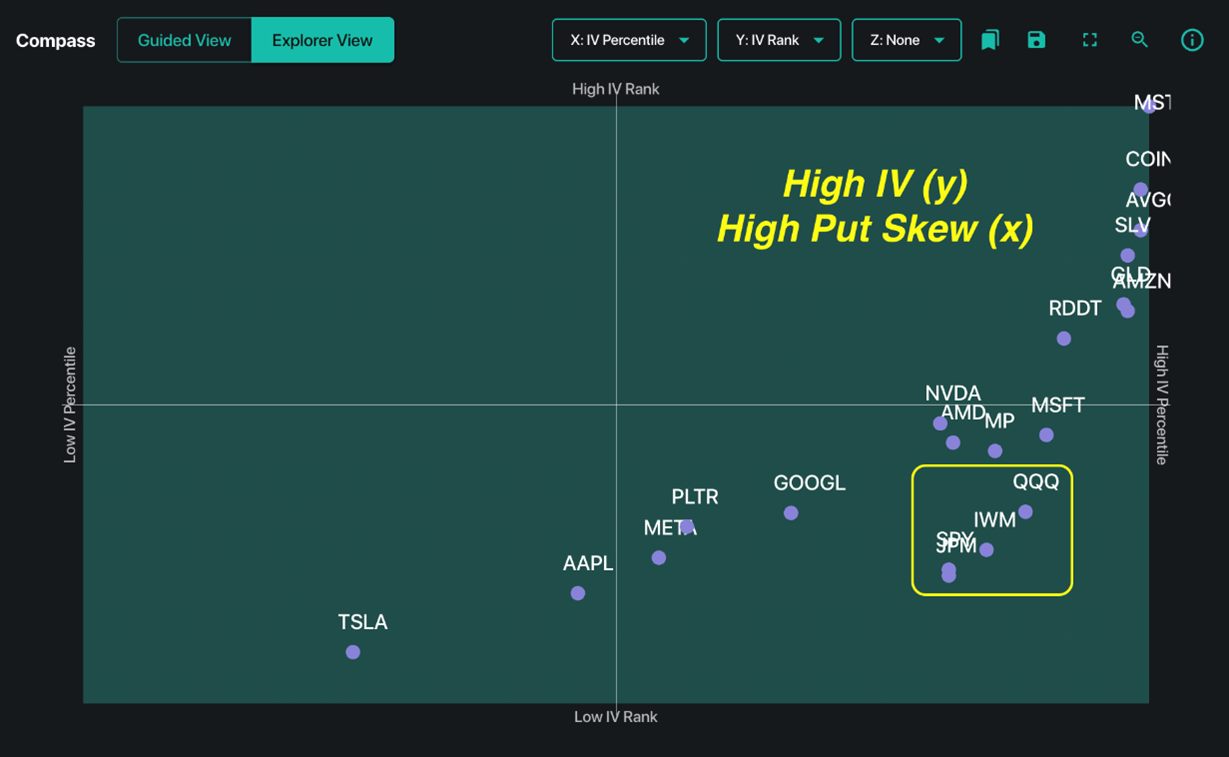

Meanwhile, the Compass here is set to IV Rank (Y axis) versus Put Skew (x axis). Those names in the top right corner are therefore either in the throes of death – like Strategy Inc. (MSTR) – or traders are bracing for impact.

Given this, we are still viewing this whole saga as a re-normalization of vols. Just as stuff had to over-travel to the upside (i.e. calls getting too bid), it seems we have to drive those put values to extremes, too. Some stuff seems to be getting on objectively fat risk premiums, which should start to draw out some vol sellers. If and when that happens more broadly, it will offer some stability to markets.

Software selling has been infecting the State Street Technology Select Sector SPDR ETF (XLK), and the Mag 7 stocks are quite frankly not offering a bid. Losing the leaders, so to speak, has not yet impacted the indices…but that is the concern.