Sure, tech stocks have gotten pummeled in 2026. But there’s more to life (and portfolios!) than tech. Seven out of 11 S&P 500 Index (^SPX) sector ETFs were showing positive returns as of last Thursday – demonstrating the benefits of digging a bit deeper as an investor.

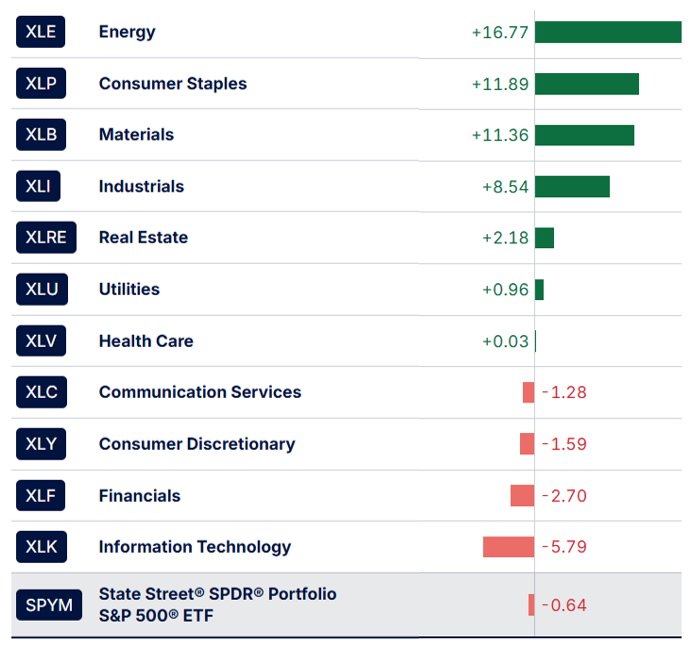

Take a look at my MoneyShow Table of the Day. Yes, technology is bringing up the rear this year, down 5.7%. But energy is a having a great 2026, up 16.7%. Consumer staples (11.8%) and basic materials (11.3%) are doing just fine, too. Even a couple of the losing sectors (communication services and consumer discretionary) aren’t hurting you THAT much.

S&P 500 Sector Performance (YTD % Change)

Source: State Street Investment Management

The bottom line? A little bit of homework can go a long way. Katie Stockton of Fairlead Strategies shared some of the sectors and stocks she’s favoring in our latest MoneyShow MoneyMasters Podcast. They’re definitely worth a look.

I also shared some thoughts last week on what it means for the broader markets. The short version is this: Stock market ROTATION is fine. Stock market LIQUIDATION is the real problem. As long as money that’s leaving sectors like tech shifts to other sectors – rather than cash – the overall market can do okay. So far, so good on that score!