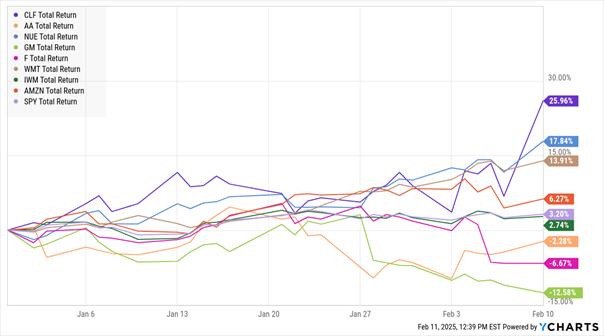

Who “wins” and who “loses” from the Trump Administration’s tariffs? You’ll hear a lot of opinions from economists, politicians, analysts, and others. But what do the charts “say”?

In my MoneyShow Chart of the Day, I show the year-to-date performance of a wide range of stocks (and two ETFs). A few things stand out...

Tariff Winners & Losers? It’s Complicated.

Data by YCharts

Steel MAKERS like Cleveland-Cliffs Inc. (CLF) and Nucor Corp. (NUE) are loving the news of 25% tariffs on steel and aluminum imports, regardless of source. CLF was recently up around 26% YTD, while NUE was up 18%. For its part, aluminum maker Alcoa Corp. (AA) is now trying to rebound after a rough start to February.

Meanwhile, big metals USERS like Ford Motor Co. (F) and General Motors Co. (GM) are having a rough go of things. F is down around 7%, while GM is off more than 12%. Tariffs aren’t the only issue automakers face, of course. But traders are clearly putting these stocks in the “L” column.

As for big retailers, which theoretically could get hit if tariffs drive up consumer goods prices and people spend less? The two largest US ones seem to be riding things out just fine. Walmart Inc. (WMT) is up almost 14% on the year, while Amazon.com Inc. (AMZN) is showing gains of around 6%.

One last thing worth noting: The iShares Russell 2000 ETF (IWM) was recently up 2.7% YTD. That’s right in line with the 3.2% gain on the SPDR S&P 500 ETF Trust (SPY). The smaller-cap stocks in the IWM ought to start outperforming. That’s because they typically have greater exposure to the US economy relative to the SPY, which has more companies with a multinational tilt to their operations, revenue, and earnings mix. But we’re not really seeing it...yet.

Bottom line? We have a handful of clear winners and losers – and some names for whom the jury is still out. Try to stay focused on “W” stocks when trading...avoid the “L” names at the same time…and keep a close eye on those in the middle to see how things develop.