About Michael

Michael Kramer is the founder of Mott Capital, a long-only investor who focuses on macro themes, using a wide array of tools to understand what drives the market on a daily basis. He analyzes economic conditions and their potential impacts across multiple asset classes, including stocks, bonds, FX, and commodities, to better identify entry and exit points for his long-term thematic growth strategy. Additionally, he shares his research through published work and a subscription service. He is a former buy-side trader, analyst, and portfolio manager with 30 years of experience tracking market technicals, fundamentals, and options.

Michael 's Videos

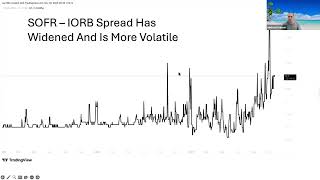

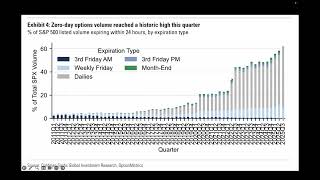

Join Michael Kramer as he explains how a combination of draining liquidity and low realized volatility sets up a potential end-of-year rollercoaster.

Falling realized and implied volatility levels have helped the market quickly recover from the Spring Tariff Tantrum. However, we observed similar price action in 2018 during the first trade war, followed by a period of significantly higher volatility levels, as economic data began to sour and tariffs started to take effect. We could consider a repeat, given that tariff levels today are significantly higher than they were in the past.

It looks like we are back to this overall view that the markets are healthy, when really it is all dependent on Nvidia and the AI trade.

A review of deteriorating fundamental data, coupled with high market-based valuations and rising interest rates, could send stock prices lower.