About Roger

Roger Conrad has successfully advised income investors since the 1980s, with a nationally acclaimed sector specialty in utilities, telecommunications, and energy. He's a managing partner at Capitalist Times and author of the book Power Hungry: Strategic Investing in Telecommunications, Utilities, & Other Essential Services. Mr. Conrad is also an independent director of the NYSE-listed Miller Howard high-income equity fund and a contributing editor to Forbes.com.

Roger's Articles

Roger's Videos

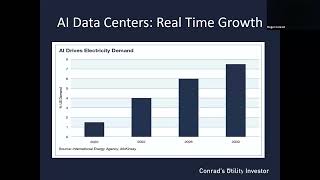

What makes AI models work behind the scenes? Power. A LOT of power. Find out how utilities are capitalizing on AI-driven demand for electricity – and how you can profit as an investor.

40-year investment veteran Roger Conrad highlights high yield, high growth pipeline stocks just getting started building real wealth in America's energy up cycle.

40-year investment advisory industry veteran Roger Conrad highlights the future of electricity and the best ways to build real wealth safely in America’s essential growth industry.

The so-called “magnificent seven” big tech stocks still get most of the attention when it comes to the artificial intelligence boom. But as they run out of steam following last year’s record gains, an up-to-now overlooked AI-linked sector is starting to pick up steam—electric utilities. Roger highlights top utility AI bets with an upside of 50% and more over the next year from this emerging great rotation.

Upcoming Appearances

Newsletter Contributions

Conrad's Utility Investor

Roger Conrad has provided in-depth analysis of the utility sector to individual and institutional investors for more than 20 years. Conrad's Utility Investor is your complete guide to building a lifelong income stream from stocks that provide essential services.

Learn More