About Omar

Omar's Articles

Omar's Videos

Silver has been quiet. It has lagged gold and the miners for the most part from the 2022 lows. However, the recent breakout rise above $35 has unlocked new upside potential, possibly as it catches up to the gold move to date. What does it mean for gold, for global demand for resources and the global economy overall? What could push silver higher? In his presentation, Omar will go through marco economic fundamentals fueling precious metals, resources and global currencies and go on a chart walk that will expose key technical levels to watch.

Gold has been on a tear as it enters the last, most manic phase of a secular bull market. The setup is very real; it’s poised to be extremely profitable and doesn’t come around often. In his presentation, Omar Ayales will take you on a chart walk to justify his take on the direction of the gold market and discuss the fundamentals driving its price today. He will also give you his top picks, positioned to deliver alpha performance in 2025.

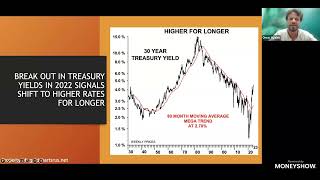

Executive editor of Gold Newsletter Brien Lundin and editor of Gold Charts R Us Omar Ayales discuss the current "golden era" in precious metals and investment opportunities. Lundin highlights central bank buying, de-dollarization efforts, and potential U.S. investor participation as gold prices rise. He predicts silver outperforming gold and recommends junior mining stocks. Ayales focuses on the shift to an inflationary environment, global fragmentation, and increased gold holdings as a reserve asset. Both experts note the lack of U.S. investor participation as a bullish sign and provide price targets for precious metals.

Newsletter Contributions

Gold Charts R Us

GCRU is a weekly trading service that looks to assist its subscribers achieve gains by trading commodities, currencies and stocks through the application and interpretation of technical analysis and proprietary indicators that have been developed over the years.

Learn More