Follow

About Scott

Scott Andrews is CEO of InvestiQuant, a financial technology firm established in 2008 that helps investors take advantage of the compelling portfolio benefits of automated trading strategies. Mr. Andrews pioneered the development of machine-learning techniques for short-term market forecasting and served as principal of a capital management firm that was recognized as Best Newcomer by HFM Global. Prior to InvestiQuant, he co-founded a software company and took it public on the NASDAQ exchange. Mr. Andrews earned his MBA from the University of North Carolina and is a graduate of West Point.

Scott's Videos

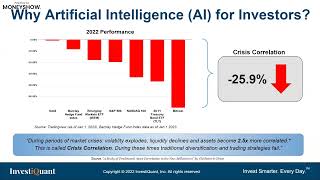

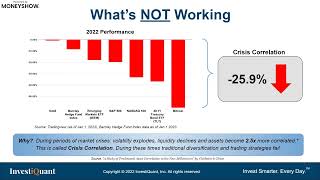

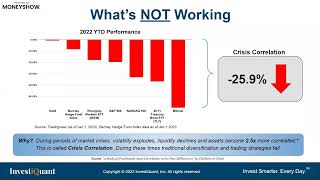

Diversification is king when it comes to protecting and growing one’s wealth. Unfortunately, even the most diversified portfolios (by traditional standards) took a beating in 2022 due to a little-known market risk called “crisis correlation” and most remain underwater despite the past year’s rally. Join former public tech company CEO, Scott Andrews of InvestiQuant, in this eye-opening session to learn about this costly phenomenon and how to overcome it. Scott will also introduce the company’s innovative investment programs and how they have delivered compelling returns to family offices and investors of all sizes over the past two turbulent years.

If you are concerned that 2022 was the beginning of the "The Great Unwind" and that most stocks and assets may struggle in years to come, you are not alone. Fortunately, advances in fin tech and A.I. are helping investors of all sizes empower their accounts with fully automated, self-learning hedge fund strategies using InvestiQuant's innovative autotrading programs. Unlike hedge funds, InvestiQuant's hands-free solutions systematically trade your account for you alongside our founders' accounts and hundreds of other investors. And, with 24/7 access and control of your capital at all times, you can be confident your investment is in good hands. Join former public tech company CEO, Scott Andrews, to see if this might be just the addition your portfolio needs.

It took 16 years for the NASDAQ to recover from its 80% "dot com" meltdown and 6 years for the S&P 500 after its 56% correction during the Great Recession. If this bear market follows suit, there's more selling to come in 2023. So, why not diversify with a portfolio solution that is a proven hedge (double-digit returns in 2022) for stock market exposure?

Unlike most alternatives, InvestiQuant's sophisticated, fully automated solutions trade your account for you--along with our founders' accounts and hundreds of other investors--providing you with 100% visibility, access, and control. Join former public tech company CEO, Scott Andrews, and see if an institutional quality auto-trading program might be just what your portfolio is missing.

Unlike most alternatives, InvestiQuant's sophisticated, fully automated solutions trade your account for you--along with our founders' accounts and hundreds of other investors--providing you with 100% visibility, access, and control. Join former public tech company CEO, Scott Andrews, and see if an institutional quality auto-trading program might be just what your portfolio is missing.

Volatility and traditional diversification crushed most portfolios in 2022, but it doesn't have to be that way in 2023. Fourteen years ago, we made our name helping investors take advantage of the Great Recession using sophisticated, short-term strategies. These same techniques have generated impressive returns, >50% net verified gains, for iQ Meta (small investor program) in 2022.