ETFs, MONEY MANAGEMENT

Benjamin Gossack, CFA

Portfolio Manager, Fundamental Equities,

TD Asset Management Inc.

Follow

About Benjamin

Benjamin is Lead Manager for the TD Tactical Monthly Income Fund, TD North American Dividend Fund, TD North American Dividend Model, TD Balanced Growth Fund, TD Diversified Monthly Income Fund, TD Active Global Enhanced Dividend ETF (TGED), and TD Active U.S. Enhanced Dividend ETF (TUED). He is Co-Manager for the TD Global Equity Focused Fund, TD Global Tactical Monthly Income Fund, TD U.S. Dividend Growth Fund, TD U.S. Dividend Model, TD U.S. Monthly Income Fund, TD U.S. Equity Focused Fund, PIC North American Blue Chip Model, TD North American Sustainability Leadership Model, TD North American Sustainability Balanced Fund, and the TD North American Sustainability Equity Fund. He previously held Primary Analyst responsibilities for the global banking, global technology, global media, and global telecom sectors. Benjamin started his career at the company as a member of the Derivatives Team, where his responsibilities included portfolio management and research for derivative-based portfolios and passive strategies. Prior to joining the firm, he spent five years as an Engineering Analyst in the Aerospace industry. Benjamin holds a B.A.Sc. from the University of Toronto and an MBA from Rotman School of Management at the University of Toronto.

Benjamin's Videos

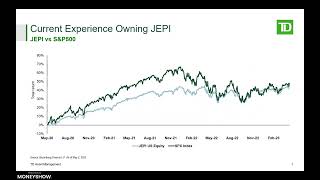

Investors looking to maximize yield on their investments often look to covered call or enhanced yield ETFs in a low interest rate, high volatility, or low growth environment. In fact, these strategies have historically been shown to outperform the broad market during periods of weakness or consolidation and many boast attractive yields to lure investors. However, not all covered call ETFs are created equal and it is important to look under the hood when investing in these products. Maximizing yield above all other considerations may come at a significant cost that many investors may be unfamiliar with.