Follow

About Lyn

Lyn Alden Schwartzer is the founder of Lyn Alden Investment Strategy and is a contributing analyst to ElliottWaveTrader.net covering equities and alternative investments. With a background blending engineering and finance, Ms. Alden blends fundamental research with a global macro overlay to find opportunities in markets around the world.

Lyn's Videos

This presentation will begin with an analysis of the major supply and demand drivers of bitcoin price action, and why bitcoin is a useful portfolio asset from a trading or investing perspective. The second half of the presentation will cover the venture investment landscape of the digital asset industry, with a focus on the pitfalls to avoid.

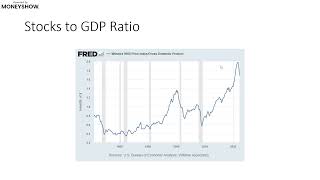

The 2020s are unlikely to provide the type of straight-up stock market that investors became accustomed to in the 2010s, especially in inflation-adjusted terms. Equity valuations started this decade at much higher levels and higher interest rates, and tighter labor conditions may place longer-term pressure on both equity valuations and profit margins going forward. Lyn Alden will discuss income-oriented strategies to generate returns even in a sideways, choppy period for markets.

Analysis of the government's large projected deficits, exacerbated by the rise in interest rates, and how this situation may impact the gold market in the years ahead.

In this session, Lyn Alden Schwartzer of ElliottWaveTrader.net will discuss data, research, and stock ideas to invest profitably even in a slow growth, stagflationary environment.