ETFs

Étienne Joncas-Bouchard

ETF Strategist,

Fidelity Investments

Follow

About Étienne

Joncas-Bouchard is an ETF strategist and business development associate with Fidelity Investments and has five years industry experience. He is responsible for communicating Fidelity Canada's ETF product strategy, industry trends, competitor intelligence, and portfolio construction ideas to clients, prospects, and industry experts in Eastern Canada. Mr. Joncas-Bouchard is the host of the Fidelity ETF Exchange podcast, focused on helping advisors and investors understand how they can incorporate exchange-traded funds into their investment portfolios.

Étienne's Videos

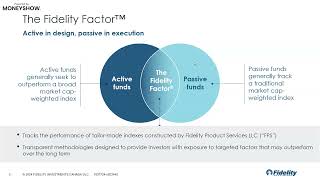

Étienne J. Bouchard, ETF Strategist at Fidelity Investments Canada discusses various investment factors and their performance through a business cycle. In a world of constant uncertainty, diversification remains of utmost importance. Étienne outlines how to build an all-weather/All-In-One ETF portfolio to help mitigate volatility, capture strategic alpha over time as well as offer competitive pricing.