Follow

About Philip

Philip MacKellar is an analyst, portfolio manager, and investor at Contra the Heard Investment Newsletter. He has been with the company since 2011 and has been investing since 2004. The newsletter's primary focus is on contrarian and value-oriented investment opportunities traded in the United States and Canada. In addition, Mr. MacKellar sometimes engages in merger arbitrage and other special situations. He also blogs about personal finance topics on his website called mymoneymoves.ca and can be followed at Seeking Alpha and on Twitter @Rallekcam.

Philip's Articles

Enghouse Systems Ltd. (ENGH.CA) has had a rough few years and is well below the highs set during the peak of the pandemic in 2020. But as contrarian investors, we have taken a stake in this enterprise and are anticipating a recovery in the years ahead, says Philip MacKeller, editor of Contra the Heard.

Ceragon Networks Ltd. (CRNT) had a rough 2025, tumbling by more than half. But the stock also had an incredible 2024, rising over 116%. All in all, Ceragon looks primed for long-term growth...and is supported by strong macro drivers and an attractive valuation. That makes it my top growth pick for 2026, writes Philip MacKeller, editor of Contra the Heard.

Lloyds Banking Group Plc (LYG) has extended its share price gains after a sharp rally earlier in the year. It was recently up 68% in 2025. Not bad for an old, stodgy British bank, observes Philip MacKellar, editor of Contra the Heard.

Neo Performance Materials Inc. (NEO.CA) has many growth drivers at its back, which makes it an ideal pick for the 2025 Top Picks report. The company processes and sells rare earth metals, magnets, and magnetic powders, highlights Philip MacKeller, editor of Contra the Heard.

Philip's Videos

Most investors wait until December to do their tax loss selling. Instead of following the crowd, we take losses earlier in the year and use December to buy beaten down securities at even lower prices. Find out more as Philip MacKellar talks about taking a tax loss, buying into December's tax loss selling, and contrarian investing more generally.

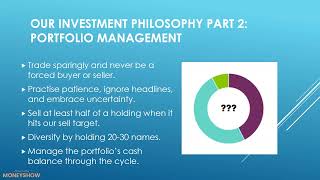

Value, deep value, and contrarian investors all face the risk of the big, bad, value trap. Is a stock in a cyclical funk or is it facing a structural headwind? When does a cyclical downturn morph into a systemic issue? And is the business fundamentally flawed or is it underappreciated by the market? Join Philip MacKellar as he discusses Contra the Heard's investment philosophy, how he tries to avoid value traps, and how he navigates these questions as he reviews his watch list and portfolio.

So, you want to be a contrarian investor? Many investors claim to act contrarian and think outside the box, but when it comes down to it, very few are actually contrary. Join Philip MacKellar and learn about his contrarian investment philosophy, how to successfully apply contrarian principles, and Contra the Heard's track record. He will also be discussing the importance of temperament, common psychological pitfalls, and what he anticipates in the year ahead.