About Ryan

Ryan Irvine is president and founder of KeyStocks.com, one of Canada's only independent stock market research advisor firms. KeyStocks.com specializes in uncovering, before the broader market, under-followed small-to-mid-sized companies that are financially sound and producing solid growth in both revenues and earnings and has a 25-year track record to prove it. Mr. Irvine has a BBA in finance, authored a syndicated financial column for eight years, which appeared in well-known Canadian publications including The Vancouver Province, Calgary Herald, and Investor's Digest. He is a regular guest on BNN and Canada's number one financial radio show Money Talks with Michael Campbell.

Ryan's Articles

Ryan's Videos

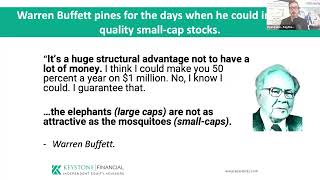

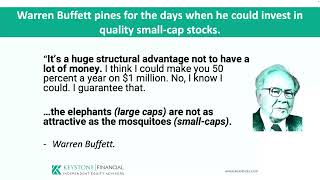

Most investors dream of finding the next 10-bagger that truly changes a portfolio, like KeyStone’s recommendations of little-known but highly profitable stocks, including Hammond Power (HPS.A: TSX) up 20,000%, Boyd (BYD: TSX) up 9,250%, Janna (JAN: TSX) (acquired at $90), WFI (WFI: TSX) (acquired at $30.60), or XPEL (XPEL: NASDAQ). To identify stocks with 10x potential, you need to know where to look. If you want to find the next 10x stock, the data is clear - the key is small, growing, profitable, and undiscovered. However, there are more than 5,000 small-cap stocks listed in the United States and Canada. We show you the key elements to identify the next 10x stock and how to position your portfolio to benefit from these game-changing investments. I will also introduce the highly profitable “Orphan Stock Opportunity” – two to three select mispriced stocks our analysts uncover every year from researching over 10,000. Most importantly, we will present to you four new buy recommendations from our research, which you can add to your portfolio today.

Most investors dream of finding the next 10-bagger that truly changes a portfolio, like KeyStone’s recommendations of little-known but highly profitable stocks, including Hammond Power (HPS.A: TSX) up 17,500%, Boyd (BYD: TSX) up 9,250%, Janna (JAN: TSX) (acquired at $90), WFI (WFI: TSX) (acquired at $30.60), or XPEL (XPEL: NASDAQ). To identify stocks with 10x potential, you need to know where to look. If you want to find the next 10x stock, the data is clear - the key is small, growing, profitable, and undiscovered. But, there are well over 5,000 small-cap stocks in the US and Canada. We will show you the key elements to identify the next 10x stock and how to position your portfolio to benefit from these game-changing investments. I will also introduce the highly profitable “Orphan Stock Opportunity” – 2 to 3 select mispriced stocks our analysts uncover every year from researching over 10,000. Most importantly, we will present to you 4 new Buy recommendations from our research, you can add to your portfolio today, including: top unknown Gold stocks, unknown profitable fintech on the cusp of a 10x opportunity, a pick & shovel Gold stock 50% under our fair value, a highly profitable US & UK lender trading under 10x EPS, and more!

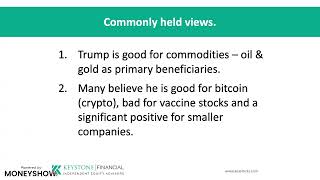

Following the Trump win, markets generally and, small caps specifically received a bump. We examine the potential winners and losers – gold, manufacturing, bank stocks, crypto, and more – in the wake of the Trump win and what to do differently, if anything, in your portfolio. Mr. Irvine will also detail why we focus on small to mid-sized profitable growth and dividend-growth stocks and how you can use KeyStone’s research to help identify the next great growth stock. 87% of all global equities that went up 1,000% or more over the past ten years started as micro/small-caps. 82% of those were profitable at the start of their ascent, and 91% had some history of profitability. Focussing on buying 15-25 stocks that match these criteria, we will show you a new way to look at stock investing and present 5 stocks you can start buying today including:

1. Top unknown Gold Stock (3-4x return potential & great growth dividend),

2. A great dividend growth stock (6%+ yield),

3. Top Cash-Rich SaaS Tech Stock,

4. Unknown Cash-Rich Pharma Stock,

5. Unknown profitable fin-tech on the cusp of a 10x opportunity.

6. and more!

Veteran analyst Ryan Irvine conducts a fireside chat Q&A with the president, CEO, and founder of VersaBank (VBNK:NASDAQ), a Canadian Schedule I chartered fully digital financial institution (bank). VersaBank obtains all of its deposits and provides the majority of its loans and leases electronically, with innovative deposit and lending solutions for financial intermediaries that allow them to excel in their core businesses. With the acquisition of a US OCC-licensed bank, VersaBank has launched its unique and proven Receivables Purchase Program in the world's largest point-of-sale financing market. Already highly successful in Canada, increasing revenue by 134% in the past two years and ranking highest on an EPS growth basis over the same period, KeyStone believes VersaBank is eying a greater than 10x growth opportunity with a unique solution not yet available in the US market. Despite the current growth in Canada and a significant opportunity over the next decade in the US, the stock trades at under nine times earnings. Ryan and Dave will chat about VersaBank’s history and the opportunity today and for the next decade. An open audience Q&A session will follow.