About Turner Capital Investments

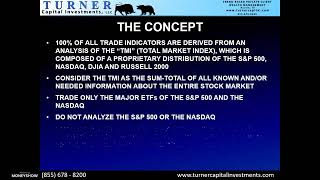

We are trend-based portfolio managers who move client capital into the market according to our proprietary algorithms that detect well-defined trends and back safely on the sidelines in high-yielding money-market funds when these trends end. We are significantly different from most asset management firms. Our proprietary trend analysis algorithms mathematically determine when the market is either bullish, neutral, or bearish. Armed with this information, we set our investment bias accordingly. This way, our clients tend to be in sync with the market trends at all times. You will like the way we grow and protect client capital...in all markets.

OnDemand Videos

Turner Capital Investments's Articles

Turner Capital Investments's Videos

The whole universe of financial advisors, analysts, pundits, professionals, and individual investors spend enormous amounts of time and money researching what is likely to happen in individual stocks, sectors, industries, and countries in the future. That, my friend, is a total and complete waste of time! They look at charts, geopolitics, products in the pipeline, fundamentals, boards, CEOs, and everything imaginable to help them make better decisions about how best to put money to work in the stock market. Unfortunately, in 100% of the cases, the future of the stock market remains totally unpredictable. Sometimes they guess right. Even a blind squirrel finds an acorn from time to time. There is a much better way. Attend this session and learn how to invest in the stock market without having to guess what the market is going to do in the future or where it is headed. See and hear how this methodology generally makes less than one trade per year, uses only two indexes, has no options, and creates a mountain of profit. You cannot afford to miss this demonstration of the breakthrough trading methodology of the century!