The Fed is done after this week’s interest rate hike. They just don’t know it yet. Meanwhile, the dollar is heading lower and rate-sensitive sectors are getting bid like I expected, notes Tom Hayes, founder of Hedge Fund Tips.

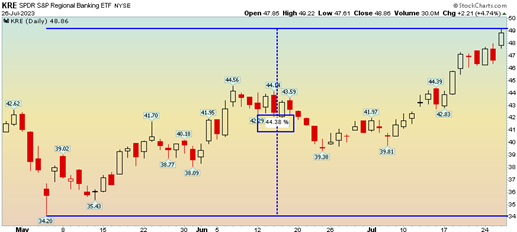

As we mentioned in our now famous “Sea Change” article from June 1, banks and small caps are now leading the way:

That falls in the “more good news” category for the stock market.

Meanwhile, everything you need to know about the Fed meeting this week is summarized by these lines in Nick Timiraos’ (The “Fed Whisperer” at the Wall Street Journal) article released in its wake:

“Powell didn’t rule out another rate rise at the central bank’s September meeting, but he emphasized how much the central bank had already done along with the amount of time it can take for monetary policy to cool inflation.”

Two jobs reports and two inflation reports before the Fed’s September meeting will put the final nail in the coffin of relentless tightening. If they stop (correctly), they will be able to keep rates elevated for some time. If they overshoot (lower probability), they will be cutting in months.

As a friendly reminder, we are moving into a seasonally weak period and volatility is to be expected. We anticipate normal 3-5% pullbacks (if they come) will be met by a large institutional bid playing “catch up” into year-end – in an attempt to salvage performance that is devastatingly missing their benchmarks year-to-date (present company not included).