The legality of marijuana has been a contentious issue in the United States for years and that reality has made investing in the drug profitably rather difficult, notes notes Jim Woods, exchange-traded fund expert and editor of The Deep Woods.

Legislation to change the federal classification of marijuana has been introduced several times over the last decade, but ultimately lacked bipartisan support to move forward. That may be changing due to the introduction of a new bill known as the Secure and Fair Enforcement Regulation (SAFER) Banking Act.

This bill was introduced by a bipartisan group from the Senate Banking Committee to provide legal protection to banks and other institutions that offer services to state-legal marijuana businesses. The goal is to improve public safety by removing the all-cash and potential criminal element in these financial transactions.

Secondarily, it will also facilitate access to resources that cannabis businesses operating in the United States have sorely lacked. It would ultimately take away power from money laundering and organized crime that allegedly is rampant throughout the retail segment of this industry.

The SAFER Banking Act is the first of its kind to gain broad support in the Senate and has industry experts watching how close the passage of this legislation will ultimately be. Several key changes were recently introduced to gain support from Republicans on this issue and allow for a federal rollout of banking protections.

Naturally, this could be a positive catalyst for ETFs centered around the cannabis industry.

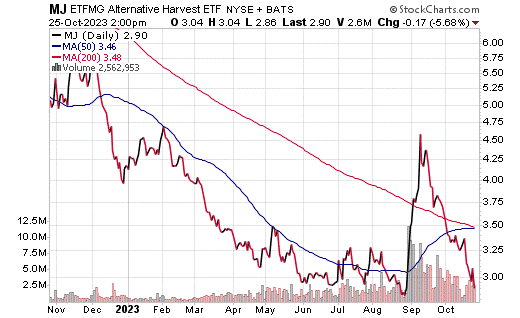

The ETFMG Alternative Harvest ETF (MJ) is the first cannabis-focused ETF to trade in the United States. It tracks the Prime Alternative Harvest Index, a collection of global firms that derive more than half their revenue from the legal cultivation, production, marketing or distribution of cannabis products for either medical or nonmedical purposes.

MJ also holds stocks of companies that trade or produce tobacco products, fertilizers, plant foods, pesticides and equipment for cannabis or tobacco. Weightings are determined through a proprietary methodology, either by market cap or equally, depending on a company’s engagement to cannabis. The index is reconstituted and rebalanced quarterly.

At present, MJ has an accumulated market value of $217.16 million, and an expense ratio of 0.75%. Its current top holdings include SNDL (SNDL), Cronos Group (CRON), Tilray Brands (TLRY), Canopy Growth (CGC) and Aurora Cannabis (ACB).

The fund is down 21.69% in the past month and 29.30% year to date. Despite the sustained pullback, I suspect that if the SAFER Banking Act is passed into law, it could give MJ investors who hunger for an upturn what they crave.

Before anyone indulges in MJ, it’s important to remember that not every investment will have you soaring sky-high. Remember to always consider your personal financial situation and goals before making any investment. Investors are always encouraged to do their due diligence before adding any stock or ETF to their portfolios.