Investors are keeping a close eye on Washington as the shutdown countdown nears zero. Stocks, crude oil, gold, and silver are all pulling back modestly, while Treasuries and the dollar are mostly flat.

Markets are increasingly bracing for a government shutdown at midnight tonight after a White House meeting between President Trump and Republican and Democratic negotiators failed to produce a breakthrough. Democrats are pushing for health-care subsidy extensions, while Republicans want to fund the government through Nov. 21 and continue negotiations on longer-term issues between now and then.

As with past shutdowns, the economic impact of this one will depend on its length – and whether the administration follows through on threatened federal firings this time around. Hundreds of thousands of government workers will be furloughed and miss out on paychecks after Wednesday. Key data releases like Friday’s September jobs report from the Labor Department will also be delayed. If the shutdown drags on, government contractors will likely temporarily lay off workers, too.

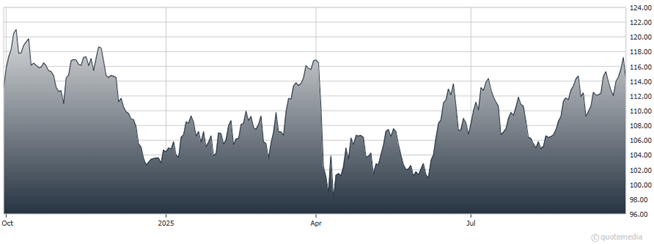

XOM (1-Year Chart)

Speaking of job cuts, energy giant Exxon Mobil Corp. (XOM) said it will let about 2,000 workers go – around 3% of its global workforce. Canada’s Imperial Oil Ltd. (IMO), which XOM owns 70% of, is also slashing 20% of its workforce. Crude oil prices have slumped almost 8% in the past year, causing the industry to retrench. Exxon has also been trying to boost efficiency and cut billions in annual costs via a multi-year restructuring process.

Finally, Citigroup analysts now say Artificial Intelligence (AI) infrastructure spending will top $2.8 TRILLION through 2029. That’s up from an earlier estimate of $2.3 trillion. Data centers packed with cooling equipment and massive amounts of tech gear are going up all over the country, while power-generation and transmission facilities are being built to serve them. But some observers worry too much money is being spent now for too little payoff later.